JLL presents the analysis of the branded hotel room supply dynamics in 2018 and plans for new openings in 2019 in Russia, CIS and the surroundings.

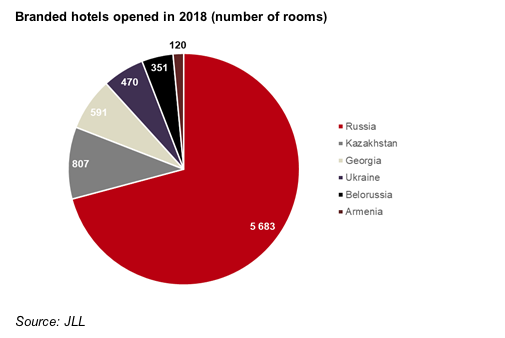

“Compared to the previous three years, 2018 was a breakthrough in terms of branded room supply growth. According to the preliminary assessment, 29 percent more branded rooms were put into operation in 2018 – 8,000 vs. 6,200 in the previous year. At the same time, in Russia 1.5 times more rooms entered the market: on the background of the 2018 World Cup preparations, hotel market here gained 5,700 new keys compared to 3,700 in 2017. Almost half of the new branded supply volume was in hotels opened in the World Cup host cities (3,400 rooms),” says Tatiana Veller, Head of JLL Hotels & Hospitality Group, Russia & CIS.

Georgia appeared as the second most active hotel market in terms of new hotel room supply (807 rooms), followed by Ukraine (591 rooms) and Armenia (470 rooms). “Surprisingly, Kazakhstan which was confidently positioned in the top 3 over the last three years, fell to the fifth place with only 351 rooms put into operations in 2018,” notes Tatiana Veller. “Obviously, at the moment this market is experiencing a slowdown after the craze of preparation for the Astana Expo 2017 event. Georgia, on the contrary, as an uprising hot touristic destination, is now experiencing a hotel development boom.”

Among urban destinations such cities as Moscow (over 1,700 thousand keys), Kyiv (591 keys), St. Petersburg (539 keys), Yerevan (470 rooms) and Tbilisi (402 rooms) appeared to become leaders in terms of branded supply addition.

It is worth mentioning that hotel operators were surprisingly accurate in their new room stock predictions this year: deviation from the official announcements in December last year was only 14 percent (slightly below 9,300 branded rooms were supposed to be added in 2018). Unexpectedly, forecast for the Russian market was even more accurate: a difference within 5% from the initial assessment (about 6,000 keys were planned). Such precision is witnessed for the first time in the history of observations.

Among the new destinations for the branded hotel openings JLL experts highlight the ongoing expansion of Azimut Hotels to the remote Russian regions and small touristic centers, namely Suzdal, Pereslavl-Zalessky, Nalchik, Kemerovo, Kyzyl, Mirny (Yakutia). In Georgia, besides the opening of four new hotels in Tbilisi, brands expanded to the regional cities: Shekveteli (Autograph Collection by Marriott), Sairme (Best Western). For the first time in several years an internationally branded hotel was opened in Almaty – Mercure with 117 rooms by AccorHotels.

A French chain AccorHotels, previously a second place by room stock growth in region, has now become a confident leader (the operator has added to its regional portfolio more than 1,400 keys in 2018). Brand with the Russian roots, Azimut Hotels confidently broke into the top 3 with 1,300 new keys, while the third place was taken by Marriott International (1,200 keys put into operation). Azimut’s result is even more respectable considering that the brand is not currently developing in CIS and surrounding countries.

“Hotel supply in the region is becoming more diverse and non-standard, growing with the large number of midscale properties, boutique and lifestyle hotels,” comments Tatiana Veller. “2018 brought several projects of this type, including Pentahotel in one of the book-houses on New Arbat street in Moscow, Meininger Hotel in the building of the Nikolskye Ryady in St. Petersburg, Moxy by Marriott in Tbilisi.

Next year, hotel brands expect to keep the same pace and plan to open about 8,000 rooms in the region. Notably, for the first time Russia’s share in this volume will be less than 50%, about 3,800 rooms. Georgia will retain the second place (almost 1,600 rooms are projected), Kazakhstan will return to the third place (over 900 rooms), according to JLL figures.

“Although the current operators’ estimation of the room stock expected in the Russian market next year is one third less than previous year, this shortcoming is solely a result of the extreme hotel development activity during the final preparation period for the World Cup. Announced plans still exceed the previous years’ volumes,” says Tatiana Veller. “Simultaneously, in the cities that hosted the games, branded openings pace will now slow down: in Moscow international brands are planning ‘only’ 1,100 rooms. In St. Petersburg, new branded hotels have not been announced yet, whereas in Yekaterinburg, Rostov-on-Don and Sochi mainly the delayed mundial projects will be put into operation.”