As many as 165 tenants, developers, investors, coworking operators and media representatives from Poland and abroad attended the conference Coworking in Poland – Where Next?, during which global real estate services firm Cushman & Wakefield presented its report Coworking sector in Poland and latest data on the Polish flexible office market.

Flexible leasing is one of the biggest disruptors in the office real estate industry globally. In the last few years, this phenomenon has revolutionized the traditional perception of an office as a workplace. Flexible spaces have become one of the most important changes observed on the office market since the transition from cellular offices to open spaces. The growth of this market segment was fuelled primarily by the technology boom, generational changes and the emergence of the sharing economy.

Emma Swinnerton, EMEA Head of Flexible Office Leasing Solutions, Cushman & Wakefield, said during her talk on coworking: “This sector’s growth has disrupted the office market. Demand for such space is rising very rapidly worldwide. The core markets to watch are London and New York, where key market players are introducing novelties. As demand for flexible leasing continues to rise, coworking operators will face a growing number of challenges going forward. In contrast to traditional offices, coworking offers more flexibility and security under short-term leases. For corporations, coworking is an excellent product that helps them establish cooperation with smaller entities and organise a temporary office to continue operations whilst waiting for a new space to move into.”

Flexible workplaces are an extremely important element of the European economy and are becoming increasingly common across cities. Coworking is a response to changing occupier requirements and the growing importance of such values as community, openness, collaboration and accessibility.

Catherine Bai, Senior Research Analyst, EMEA Research, Cushman & Wakefield, said that London, New York and Berlin were the world’s top coworking space locations: “The expansion of the flexible leasing sector is being driven primarily by large operators such as WeWork coming onto the market. That’s why any city with a suitable office stock available for immediate occupancy and easy access to urban transport infrastructure is likely to see a further growth in coworking space.”

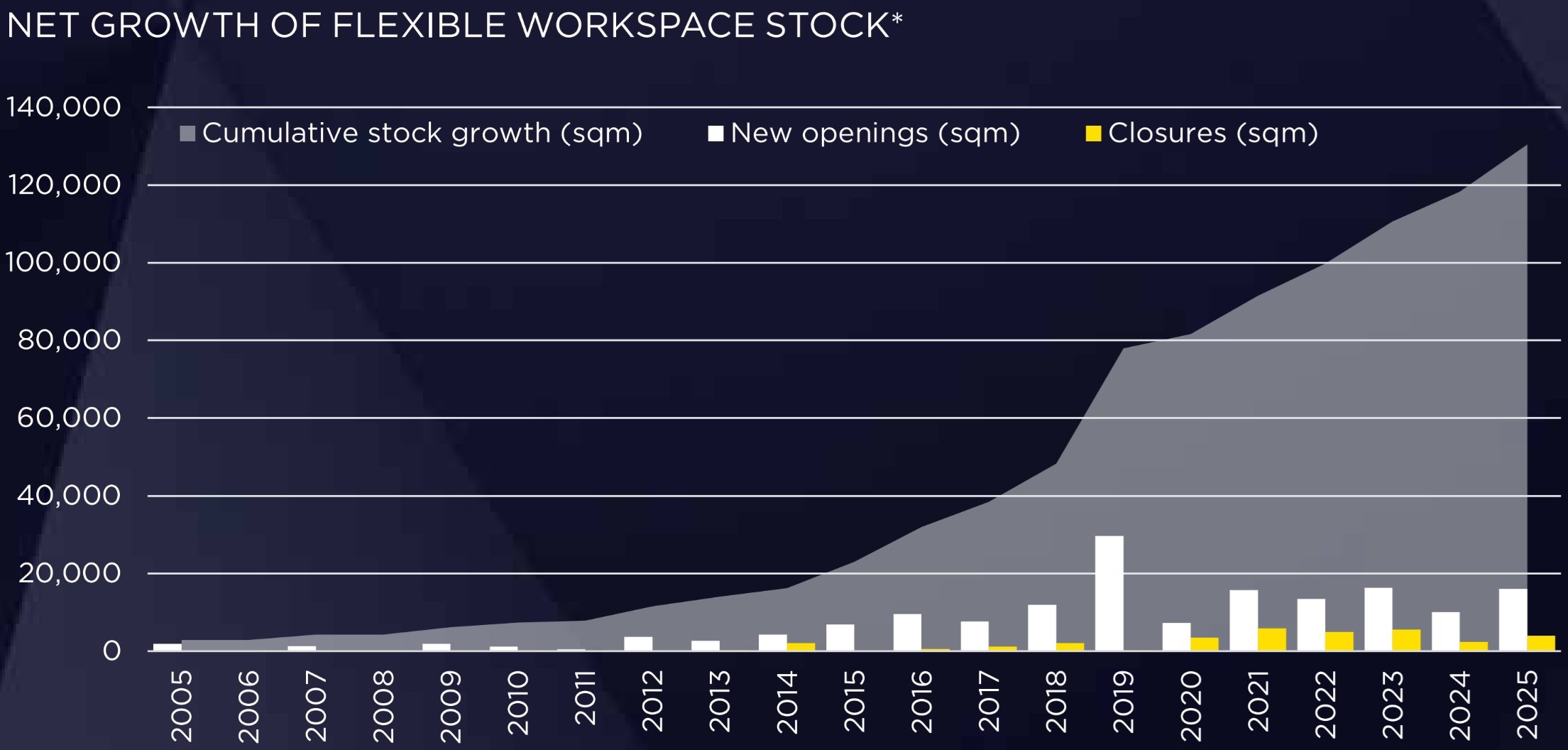

Companies offering serviced office space have been active in Poland for over 20 years, while the growth of coworking spaces began approximately seven years ago. The first small coworking operators primarily offered small units averaging 200 sqm and located in detached houses, tenement or industrial buildings in non-central areas. Warsaw is by far the largest flexible space market with 77,400 sqm of coworking space, which accounts for approximately 70% of Poland’s total coworking stock. Outside Warsaw, the highest concentration of coworking space is in Krakow, Poznań, Tricity, Wrocław and Katowice.

Katarzyna Kotkowska, Associate, Valuation and Advisory, Cushman & Wakefield, and Mikołaj Niemczycki, Coworking Clients Manager, Office Agency, Cushman & Wakefield noted during their presentation of the report findings included in Coworking sector in Poland that a total of 37,600 sqm of coworking space was opened in Warsaw in 2018, which made coworking operators one of the fasted-growing groups of tenants. This sector’s year-on-year growth averaged 70% in the last five years. Under leases transacted in 2018, nearly 74,100 sqm will be added to the city’s coworking stock in the next two years, which is expected to reach 151,000 sqm at year-end 2020. “We expect the final volume to be higher as coworking operators continue to search for new leasable space,” commented Katarzyna Kotkowska. Mikołaj Niemczycki added: “60 percent of Warsaw’s total coworking stock is in central locations which are the most sought-after by tenants as they usually offer the most added value such as good public transport accessibility or convenient access to a variety of amenities such as restaurants, cafés, fitness clubs or city bike rental stations.”

Beside central locations, coworking centres are also developing in revitalised tenement houses or Class A office buildings in the Praga district, whose stock accounts for 14 percent of all coworking space in Warsaw. The Ursynów and Wilanów zone has a 7 percent share in total coworking stock despite a relatively limited overall volume of office space.

With 12,000 sqm of coworking space in three locations (the National Stadium, Astoria Premium Office and Zebra Tower), Business Link was the largest coworking operator on the Warsaw office market in 2018. WeWork opened its first location at CEDET and another one in the first phase of the Browary Warszawskie complex in January 2019, now offering a total of 9,700 sqm of leasable coworking space. Other active market players included Solutions.Rent (a total of 6,700 sqm in two locations: Małachowskiego Square and Ethos) and NewWork with two locations: Be The One and Mazowiecka 2/4.

“WeWork connects over 400,000 members around the world with the collaborative environment, thoughtful design and inspiring events that can help them create their life’s work, whether they’re start-ups, entrepreneurs, larger enterprises or FTSE 500 companies. In response to demand from our members, opening in Poland was an obvious next step for us. It is one of the biggest and fastest-growing economies in Central Europe and a hub for tech, media, transport and government. There are more than 300,000 companies registered in Warsaw alone, 3,000 of which are start-ups, proving it a highly desirable business location, and we hope to contribute to this booming local economy by bringing new members into the city,” said Misha Konoplev, General Manager, WeWork Central & Eastern Europe.

Two panel discussions were held during the conference “Coworking in Poland – Where Next?”. One of them “Coworking tenancy vs. investment market – added value or reduced liquidity?”, was chaired by Soren Rodian Olsen, Partner, Capital Markets, Cushman & Wakefield, who said: “Coworking tenancy has become a key feature in several core office buildings across Poland, in particular in new developments in central locations. The investment market has been fast to adopt and accept coworking tenants. In the Polish market investors have welcomed the coworking component, partially due to longer lease terms (10-15 years), partially due the occupier market trends where coworking is widely regarded as an added value to other tenants and to the building itself. Looking ahead, we can expect 4 out of 5 core office investment transactions in Warsaw’s CBD to feature a coworking operator.”

Anna Górska-Kwiatkowska, Associate, Office Agency, Cushman & Wakefield, who chaired the other discussion “Coworking & Corporations”, said: “Over the last three years, we have observed the unprecedented expansion of coworking sector all over the world. Until recently, coworking centers were popular among start-ups, small enterprises and freelancers, but now we can observe a substantial growth in demand from corporations. Flexible office space will continue to attract small and medium-sized enterprises looking for attractive alternatives to traditional offices, but in the coming years we are likely to see an increasingly diversified structure of coworking space users as corporates will come top of the league table as the largest group of coworking tenants. Until now the demand coming from corporations was estimated at the level of 8 percent but given the growing interest, it can soon double or even triple. Signing lease agreements online (‘e-signatures’) and new accounting standards will be a driving factor in occupiers’ decisions to leverage coworking.”

The conference Coworking in Poland – Where Next? was organised by global real estate services firm Cushman & Wakefield. It was held at WeWork’s office in Browary Warszawskie on Wednesday, 13 February, and was attended by international guests from the CEE region (Hungary, Czech Republic, Romania, Ukraine, Serbia, Turkey, etc.), Cushman & Wakefield’s experts: Emma Swinnerton, EMEA Head of Flexible Office Leasing Solutions, and Catherine Bai, Senior Research Analyst, EMEA Research. Moderators and panellists included: Soren Rodian Olsen (Cushman & Wakefield), Jacek Wachowicz (Immobel Poland), Peter Tatzl (CA Immobilien), Anna Duchnowska (Invesco Real Estate), Włodzimierz Skonieczny (ING Bank Śląski S.A.), Anna Górska-Kwiatkowska (Cushman & Wakefield), Luke Armstrong (WeWork), Michal Pietuszko (DLA Piper Giziński Kycia sp.k.), Robert Chmielewski (ShareSpace), Katarzyna Szymczak (PayU), Mikołaj Niemczycki (Cushman & Wakefield) and Katarzyna Kotkowska (Cushman & Wakefield).