Strong investment activity is seeing property yields continue to fall in many European markets, with the best buying opportunities existing in the industrial sector, according to research from DTZ.

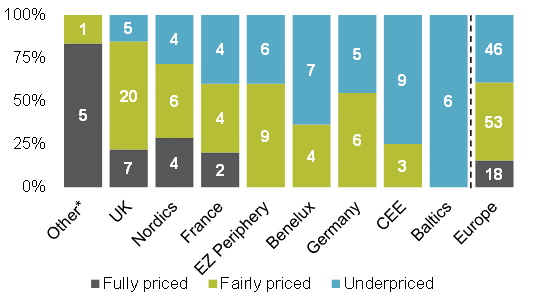

The European Fair Value Index identifies Europe’s most attractive office, retail and industrial markets for prime commercial property investment on a five year hold period. The report shows that Europe still offers plenty of opportunities to invest, with 46 markets classified as underpriced in the Q2 analysis. The top ranking markets this quarter are all industrial markets, located in Belgium, Denmark and the Baltics.

DTZ’s overall Fair Value Index for Europe fell to 62 in Q2 2015 from 69 the previous quarter, meaning that although commercial property markets are still attractively priced, their relative value compared to government bonds has deteriorated, narrowing the window of opportunities for investors.

Magali Marton, DTZ’s Head of Research for EMEA, said: “The European commercial property market continues to offer attractive opportunities for investors and we think industrial property in particular offers good value due to its high yields. The progress made towards a new Greek bailout agreement has lessened the uncertainty over the Eurozone and its property market, although Greece’s long term future remains in question.”

Investor demand for European property maintained strong momentum in Q2 as volumes almost reached 2007 levels on rolling annual figures. Strong investor demand saw prime yields fall this quarter in 40 percent of the 117 markets in DTZ’s European Fair Value Index causing the overall index score to fall.

Fergus Hicks, DTZ’s Global Head of Forecasting, said: “There are still plenty of opportunities to invest in European property, which continues to look appealing against the low bond yields which are prevailing at the moment. Germany for example is looking attractive, with a good balance of under and fairly priced markets.”

The top five most underpriced markets this quarter are all industrial, but located in different parts of Europe: the Baltics, Benelux and Nordics. The top three markets show as underpriced by 20 percent and more according to DTZ’s fair value analysis, with Brussels offering the best value, at 24 percent below fair value. In contrast, many core European markets are classified as fairly priced.

Matteo Vaglio Gralin, Associate Director at DTZ, said: “Looking forward we expect the fair value index to fall further as more European property markets become fully priced. However, investors willing to seek them out will still find attractive opportunities.”

The findings are based on the DTZ European Fair Value Index, which provides a quarterly insight into the comparative attractiveness of current property pricing across 117 European markets. The classification for each market, based on a five year hold period, is determined by comparing the forecast return and the risk-adjusted fair/required return. A score of 100 indicates that all markets in the index are underpriced and zero that all markets are fully priced. A score of 50 indicates a balanced number of fully priced and underpriced markets. In Q2, 46 markets were rated as ‘underpriced’, 53 ‘fairly priced’ and only 18 as ‘fully priced’.