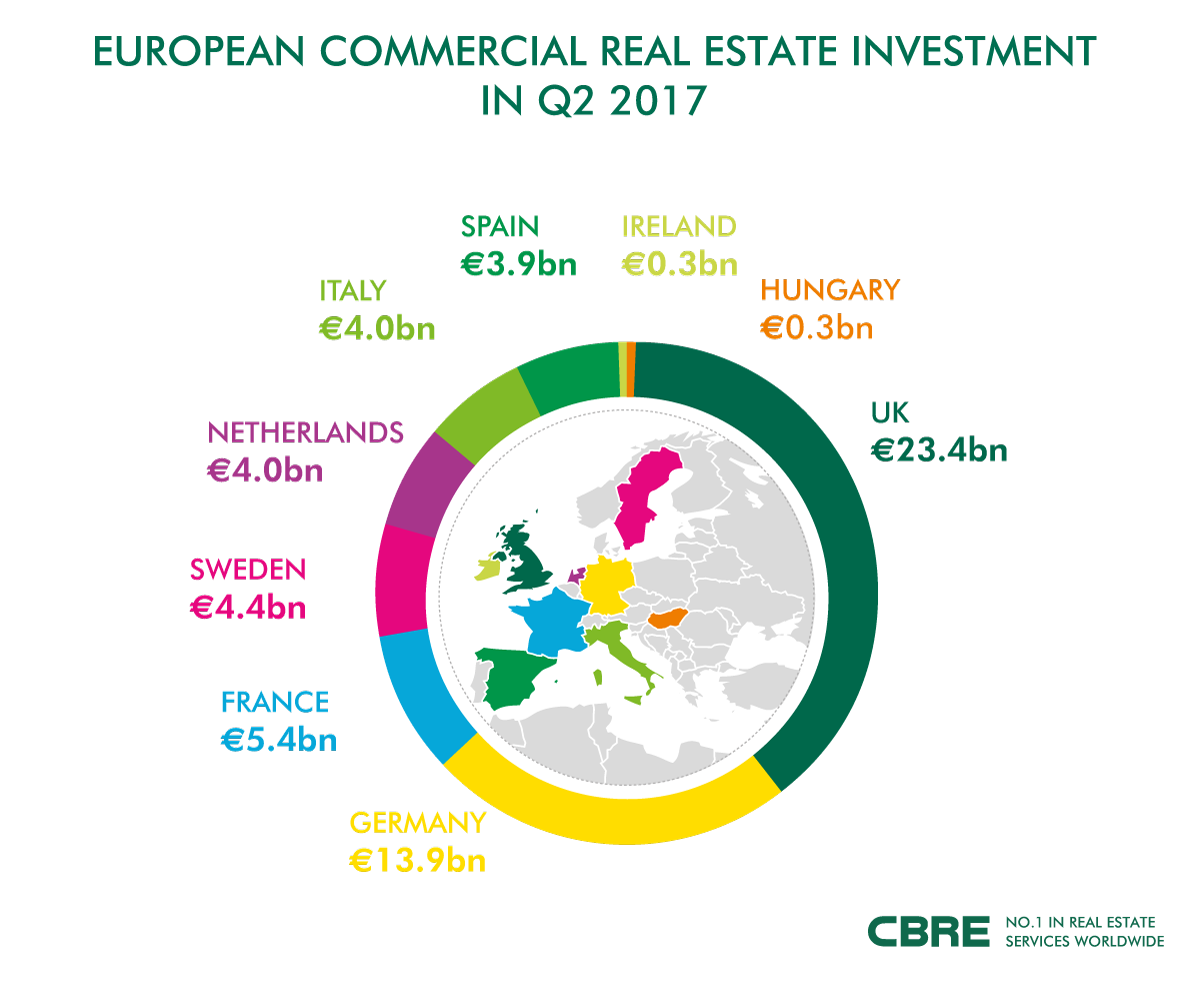

Total real estate investment in Europe reached €74 billion in Q2 2017, representing a 25 percent increase on the same period last year, according to CBRE. Central Europe as a region proves to be more attractive to international investors than last year with Hungary accounting 15 percent of the overall investment volume.

The strong quarterly performance was, in large part, driven by an upturn in UK trading activity with volumes reaching €23.4 billion in Q2 2017, up from €16 billion in Q1 2017, and a 54 percent increase on the same period last year. The sale of Logicor in Q2 did have substantial UK exposure but even if this large transaction were to be excluded, investment would still be trending up year on year, as market activity continues to recover from the slowdown immediately preceding and following last year’s European Union referendum.

Germany once again proved to be the driving force behind investment growth in Continental Europe which, as a region, posted 15 percent growth on the same period last year. In Germany, transaction levels for H1 2017 increased by 49% compared to H1 2016, transacting €13.9 billion in Q2 2017 and €26.5 for the first half of 2017. The Southern European markets of Italy and Spain, as well as the Netherlands, also witnessed strong investment growth over the quarter, posting 110 percent, 76 percent and 38 percent increases respectively. In France, the results for the first half of 2017 were somewhat muted; however the election of Macron in May will likely have a positive impact on occupier and investor sentiment, and the investment pipeline has strengthened going into H2 2017.

Q2 2017 was driven by robust growth in the industrial and logistics sector and, to a lesser degree, the alternative sector, as investors look to diversify their asset base. The industrial sector witnessed a 303 percent increase on the same period last year (which can in part be attributed to the sale of the Logicor portfolio) whilst the alternatives sector posted a 20 percent increase. Meanwhile, office transactions across Europe in Q2 2017 were down 6 percent on Q2 2016.

Hungarian market half-way to exceed last year’s investment volume

After an outstanding investment market performance in 2016 with €1.54 billion invested, investors spent €795 million in H1 2017 in the Hungarian commercial real estate market. Central Europe as a region proves to be more attractive to international investors than last year with Hungary accounting ca. 15 percent of the overall investment volume. The volume split across asset classes has been more levelled this year so far than in previous years. Offices still took the lead with 41 percent share in H1 2017, down from last year’s figure of 55 percent. Both retail and industrial have increased their share on last year to 31 percent and 28 percent, respectively.

Office investment volume was driven by three transactions above €50 million, all purchased by domestic funds. The average deal size was around €40 million. Capital values varied widely between €2,000-3,000/sqm as first generation and brand new office buildings were similarly traded. Largest transaction was the purchase of Nordic Light by Erste Fund (HU).

The retail investment volume was high with a total volume of €248 million – mainly driven by acquisition of two non-centrally located shopping centres in Budapest by CPI as part of a portfolio. Industrial investment volume was more diverse, including a cross-country portfolio of add-value asset and prime city logistics as well.