Civil engineering and non-residential construction are the sectors most likely to drive Hungarian construction in the coming years. Thanks to the increasing number of tenders in the civil engineering sector, particularly transport infrastructure construction and environmental protection-related construction, Hungarian construction output is to see steady growth in the coming years. However, in 2016 the construction sector may witness some decline, being mostly result of the slow execution of projects from the new EU budget.

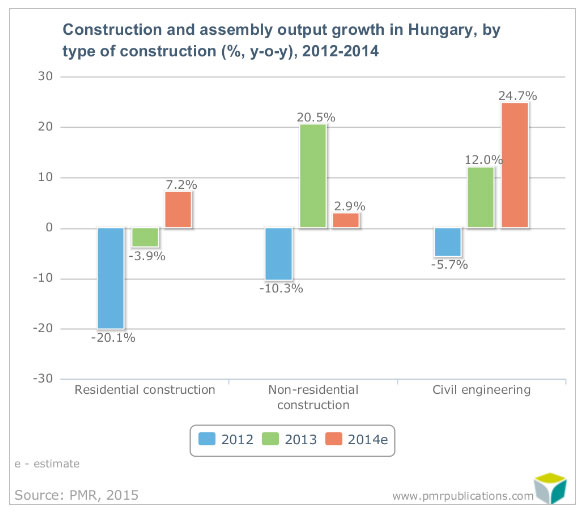

According to a new report entitled “Construction sector in Hungary 2015 – Development forecasts for 2015-2020” published by the analytical and research company PMR, following a drop of almost 9 percent year on year in 2012, Hungarian construction output recovered in both 2013 and 2014 growing by more than 14 percent year on year in each of the two years. The growth was driven mostly by civil engineering construction, which experienced an increase of over 24 percent year on year in 2014.

In non-residential construction, following an estimated rise of less than 3 percent in 2014, Hungarian non-residential construction is expected to experience nearly 5 percent increase in 2015, as a number of projects, particularly on the warehouse and office markets, are expected to begin. On the other hand, the non-residential subgroup which is likely to lag behind all others is retail facility construction. The renewal of the ban on the construction of large shopping malls last December dashed hopes of recovery among investors in this area. As a result, no major retail facility projects were unveiled in 2014, a year which saw no facilities completed in this field. Most of the output in the retail construction arena is accounted for by small developments in small towns.

Road construction is forecast to be the main generator of funding and orders for the Hungarian construction industry in the years to come. The EU budget for the years 2014-2020, which is relatively favourable for Hungary, along with the expected high rate of absorption, will stimulate public investment and employment in the economy. As a result, the amount invested in civil engineering structures will still be relatively substantial in the medium term.

However, in 2016, it is expected that expenditures covered by EU funds will be reduced significantly because of the end of the financing period for projects under the 2007-2013 EU budget. This will have a detrimental effect on public investment and, consequently, civil engineering construction.

We have already seen some signs of possible slowdown. In the first three months of 2015 the construction confidence indicator began to deteriorate again, mostly driven by slow-growing prices and still massive competition for a low number of orders.