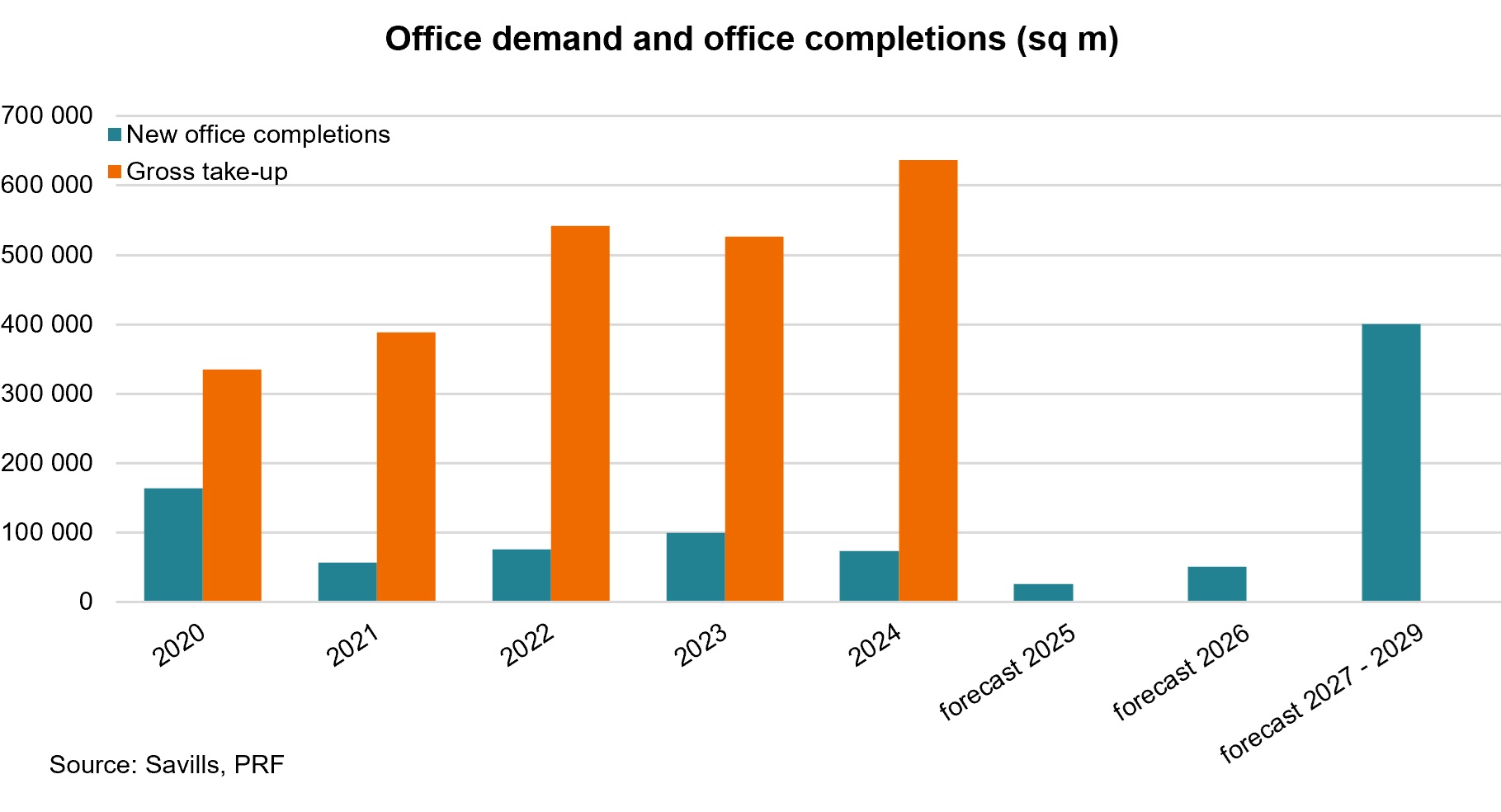

According to an analysis by Savills, office development in Prague has been declining rapidly since 2021. This trend is confirmed by 2024 figures, which show that only 72,800 sqm of new office space was completed in Prague. In 2025, the volume is expected to decrease even further, reaching just 24,600 sqm. Meanwhile, total demand, including companies that are renewing their existing leases (so-called renegotiations), exceeded a record 630,000 sqm in 2024. This creates a significant imbalance between supply and demand.

“Before 2020, annual office development was around 150,000 sqm, which now represents a decline of more than 50 percent. Currently, around 164,000 sqm is under construction across Prague, but 60 percent of this space has already been pre-leased, and another 25 percent is reserved. In reality, new tenants will have access to less than 15 percent of the space currently under construction. The biggest office shortages are in prime locations such as Prague’s city centre or Karlín, where occupancy rates for modern office spaces exceed 95 percent,” says Pavel Novák, Head of Office Agency at Savills.

Larger office projects in Prague are expected to emerge no earlier than 2027 to 2029

Pavel Novák adds: “Over the next two to three years, no dramatic increase in supply is expected. We anticipate that between 2027 and 2029, several larger projects, currently in advanced planning stages, should enter the market. If everything goes according to plan, these new office complexes could contribute to reducing the current shortage.” For companies planning their expansion several years in advance, this is an opportunity to start considering these upcoming projects now. They can secure key information in advance and have the advantage of choosing spaces among the first. Moreover, local teams of developers, architects, and other construction participants have gained extensive experience with office projects in recent years, which will be reflected in the quality of the new buildings.

Reasons why new office buildings are not being constructed

One of the most significant issues is the lengthy and complex permitting process. In the Czech Republic, there are cases where project approvals take up to ten years or even longer. During this period, costs and overhead expenses related to project preparation and the approval process accumulate. At the same time, direct construction costs – such as labour, materials, and energy – continue to rise. Although interest rates have decreased, they have not returned to previous levels, which still results in a higher financial burden. Increased costs are reflected in rental prices to ensure the financial feasibility of development projects. However, these rental rates must be accepted by the market. Differing price expectations also reduce the competitiveness of the Czech market compared to countries where projects are approved more quickly, such as Poland or other Central European nations.

Rental price growth in prime locations

The consistent demand for high-standard office space in the city centre, combined with supply shortages and persistently high construction costs, has led to a further slight increase in prime rents. By the end of 2024, headline rents for modern office spaces in Prague’s city centre ranged from €28.50 to €29.50 per sqm per month (+7 percent year-on-year). In other parts of Prague, headline rents have increased by an average of 4 percent over the past year, now ranging from €18.50 to €19.50 per sqm per month.

“We also see the emergence of deferred demand. If companies are unable to secure a suitable location with the necessary specifications, they opt to remain in their current spaces and delay their decision. This could create additional market pressure in the future as new buildings become available,” concludes Pavel Novák from Savills.