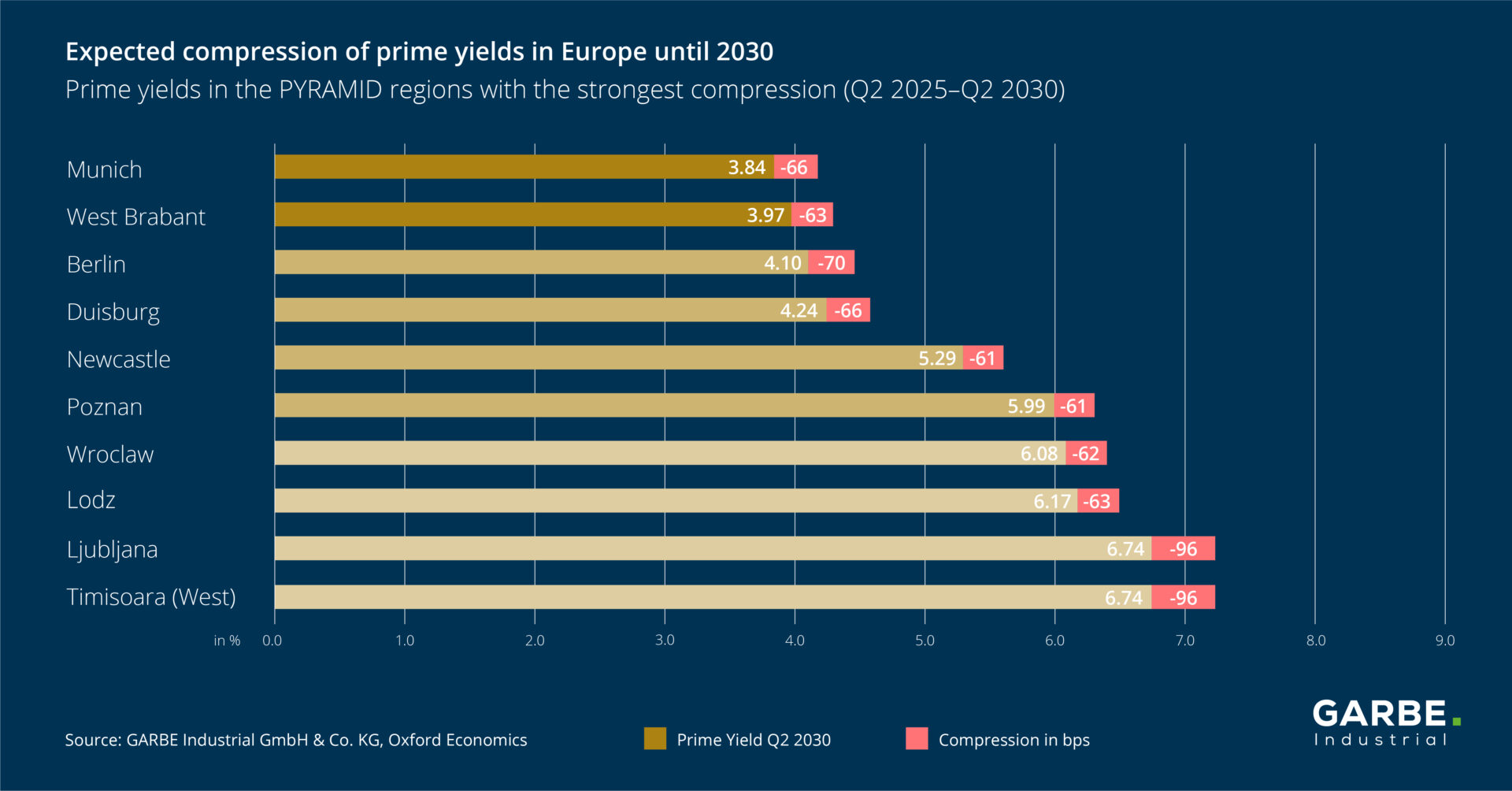

The European logistics real estate market continues to deliver a robust performance. Based on a survey of 88 regions, the latest forecast suggests a gradual convergence of prime yields between now and the second quarter of 2030. They are expected to experience a slight compression by an average of 40 basis points – driven by a moderate easing of interest rates, a subsiding risk aversion and the structurally strong faith in logistics as an asset class. These are the findings that GARBE Research presented in its latest GARBE PYRAMID MAP, the 2025 mid-year update of the company’s overview of prime rents and prime net initial yields for the 121 most important logistics real estate submarkets in 25 European countries. In addition, the PYRAMID MAP contains forecasts for the 88 regions that were determined via a collaboration with Oxford Economics.

Particularly in established markets, such as Germany, the Netherlands and the United Kingdom, the yield level has remained solid, while certain regions, such as Munich or West Brabant, could actually see their yield rates slip below the mark of 4.0 percent in the medium term.

“This trend is a sign for stability and confidence,” explained Tobias Kassner, Head of Research and ESG at GARBE Industrial. “Investors appreciate the intrinsic value of logistics real estate – despite challenging parameters, the asset class remains a reliable anchor.”

First Half of 2025: Strong Resilience, Selective Movement

Prime yields experienced no changes in 84 of the surveyed regions during the first half of 2025. The European average hardened but minimally, declining by 3 basis points to 5.58 percent. Modest yield compression was registered in 36 regions. Spain presented a particularly dynamic picture, with Zaragoza reporting a drop of 30 basis points while yield rates in Madrid and Barcelona hardened by 20 basis points each. The German market showed first signs of a resurgence. In 16 regions, yields declined by 10 basis points each – and by an actual 20 basis points in Munich. In the Netherlands, established markets like Amsterdam/Schiphol, Tilburg, West Brabant, and Venlo also saw their yield rates fall by 10 basis points. By contrast, rates in Italy and France remained stable, and even the CEE regions showed mainly sideways movement.

Stability as Central Quality Attribute

These latest findings illustrate that the European logistics real estate market has stable fundamentals, which is remarkable after the upheavals of recent years. Compared to alternative asset classes, logistics real estate maintains its position because its rents are either stable or rising and ensure that the assets’ intrinsic value is retained. Institutional investors focus increasingly on Core+ properties with rent growth potential, whereas classic core products remain particularly attractive when occupied on long-term leases.

“Stability is the key characteristic of the current market cycle,” said Kassner. “Logistics real estate has proven to be among the asset classes with the highest value retention even during tough market cycles while delivering a high cash-flow return at the same time.”