Central and Eastern Europe, the Eurozone Periphery and the Baltic regions boast the most attractive opportunities for investors. The number of attractive investment opportunities in European commercial property has receded as yields have fallen and more markets have become fully priced, according to research from Cushman & Wakefield.

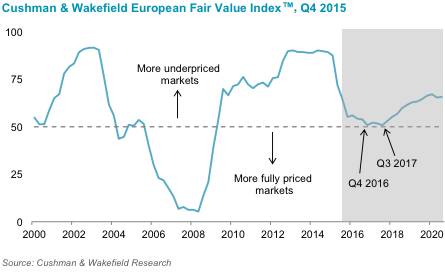

Cushman & Wakefield’s European Fair Value Index, identifies Europe’s most attractive office, retail and industrial markets for prime commercial property investment on a five-year hold period. The report shows that with Eurozone interest rates unlikely to rise until 2018, prime property yields in core Eurozone markets look likely to stay stagnant until 2017/18.

Central and Eastern Europe, the Eurozone Periphery and the Baltic regions have the highest share of underpriced markets and boast the most attractive opportunities for investors. Germany has the majority of its markets classified as fairly priced, while the UK still has 19 fairly priced markets, and is further ahead in the cycle. In contrast, Swiss markets continue to look unattractive due to their very low prime property yields, between 3.0-3.5 percent and weak rental growth prospects.

The overall Fair Value Index for Europe was 55, down from 62 in Q3 2015, meaning that opportunities for investors have further diminished.

Fergus Hicks, Global Head of Forecasting at Cushman & Wakefield, said: “We expect the European Fair Value Index to decrease in the short term as investor demand continues to push property yields lower and attractive investment opportunities diminish. Moreover, with further policy easing likely in the Eurozone, we do not expect any rises in European property yields until 2017/18 at the earliest. The office and retail indices are both expected to bottom out this year, while we expect industrial to reach its low only at the end of the forecasting period.”

Kamila Wykrota, Head of Consulting and Research at Cushman & Wakefield in Poland, said: “The analysis of the Fair Value Index focuses on total prime property yields in each market segment with a five-year investment horizon. According to our team’s latest research, the Polish commercial real estate market remains an attractive target for investors with the greatest potential of the Warsaw retail market where we expect further yields compression and slight rents increase.”