Europe’s logistics real estate market is moving through a stabilisation and consolidation phase. More specifically, an average rental growth of 70 cents per sqm is projected for the period starting with the second quarter of 2025 and ending with the second quarter of 2030. This would imply an annual growth rate of 1.9 percent (CAGR or Compound Annual Growth Rate). For the sake of comparison, the CAGR between Q2 2020 and Q2 2025 amounted to 5.6 percent. These are the findings that GARBE Research presented in its latest GARBE PYRAMID MAP, the 2025 mid-year update of the company’s overview of prime rents and prime net initial yields for the 121 most important logistics real estate submarkets in 25 European countries. In addition, the PYRAMID map contains forecasts for the 88 regions that were determined via a collaboration with Oxford Economics.

Tobias Kassner, Head of Research & ESG at GARBE Industrial, explained: “The exceptional rent surge of recent years cannot be sustained indefinitely. However, our forecast reveals: Prices continue to be stable, and high-end locations retain their growth upside.”

Top Regions Stand Their Ground – Opportunities in Specialised Markets

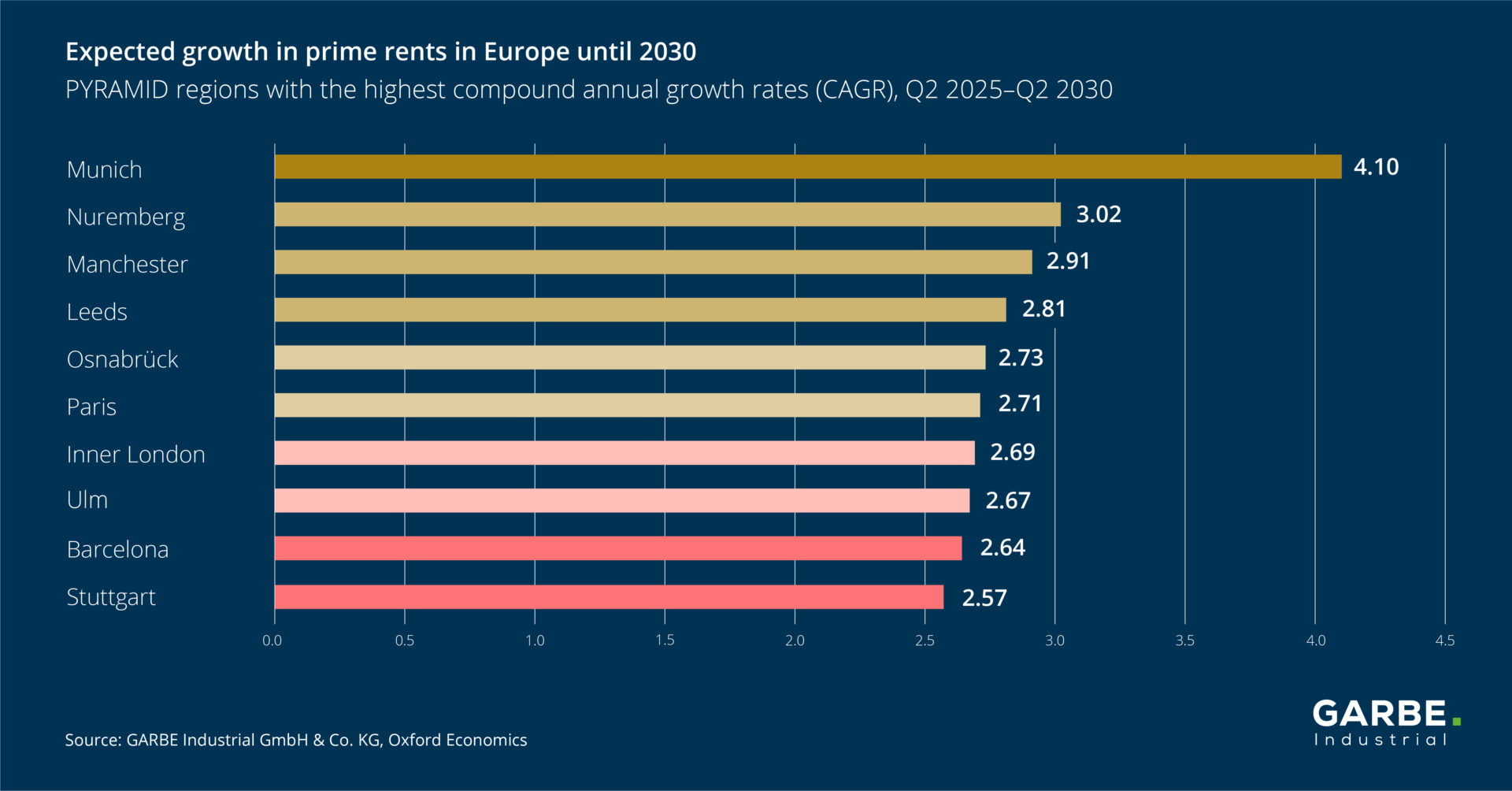

Particularly markets like Munich, Stuttgart, Inner London, Manchester, Paris, Barcelona and Warsaw will keep seeing above-average rent growth in the coming years, according to the forecast. These regions are expected to report of CAGR of more than 2.0 percent, which is due to their role as central logistics hubs. Regions that already manifested a significant potential for growth in recent years keep showing robust development outlooks.

First Half of 2025: Rental Uplift, While Slowing, Remains Stable

During the first half of 2025, prime rents in Europe increased by an average of 6 cents to 7.42 euros per square metre and month. At a rate of 0.8 percent, the rent growth was far more moderate than it had been in previous years, and lagged behind the inflation rate of 2.06 percent projected for 2025 (source: Oxford Economics). In 59 percent of the 121 regions examined, the prime rent remained unchanged. Another 36 percent of the regions registered slight increases, amounting to an average of 18 cents per sqm. Only five percent of the regions reported falling rents – down from eight percent as recently as year-end 2024. In fact, the trend suggests that rents are stabilising.

Regional Developments Present a Different Picture

In the 29 regions in Germany covered by the survey, rents increased at the same rate of just 6 cents, and without Munich, it would be a mere 3 cents. Eleven regions showed a positive trend, including five of the seven largest logistics locations. Leipzig and Magdeburg registered falling rents. In Italy, five of seven regions scored rent increases of 24 cents on average, whereas four out of ten regions in France averaged increases of 4 cents. Three of four markets in Spain recorded an average growth of 13 cents. Growth slowed to 11 cents in the United Kingdom and to 5 cents in the Netherlands.

Slight Increase in Vacancies – Ongoing Demand Differentiation

Cross-European take-up followed the same long-term trend and generally matched, or fell slightly short of, recent levels. The average vacancy rate in Europe already exceeded 6.6 percent during the first quarter of 2025. While the United Kingdom, Italy and Slovakia recorded the fastest increases in vacancies, there are first signs of recovery in Germany, Spain and Poland. The German market is gradually coming back to life, whereas market action in Austria and the Czech Republic is rather subdued.

Fresh Impulses through Policy Incentives – Quality of Location Gaining in Significance

“We expect many markets to see continued, if more moderate, rent growth – driven by structural trends, industry-specific demand and regional dynamics,” said Kassner. Political measures such as the “Super-AFA” model of depreciation deduction introduced by the German government could create fresh impulses, although no short-term effects are to be expected from these. The overall picture suggests: Despite slowing momentum, the market has remained robust – and presents opportunities for investors, especially so in regions with convenient transportation access, specialised users, and high-quality location.