Russia’s real estate investment volumes reached USD967 million in Q1 2019, up 30 percent y-o-y from USD742 million, says JLL.

“A significant investment volume increase at the beginning of the year can be explained by a few large transactions which were postponed from 2018 to 2019. Nevertheless, investors are still cautious and are adopting a ‘wait and see’ approach,” commented Natalia Tischendorf, Head of Capital Markets, JLL, Russia & CIS. “Paradoxically, investors welcome neither rouble strengthening nor weakening because it makes planning and pricing more complicated. In addition, the market faces a shortage of real estate products available for purchase and, despite the fact that economy and debt market are recovering, and senior debt financing is available at relatively low interest rates, the volume of deals under negotiations has not increased.”

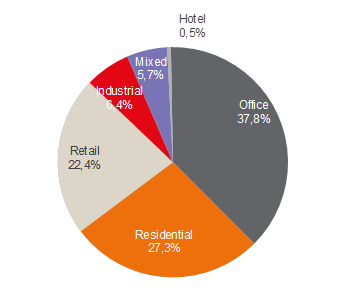

In Q1 2019, the office sector received the most investor attention, with 38 percent of the total volume. The largest office deal was the sale of office premises of Class B and C by Alexander Svetakov, Chairman of Absolute Investment Group. The residential sector (land plots for residential development and apartments under construction for investment) followed (27 percent) due to the purchase of residential complex Prime Park by A1, a key investment subdivision of Alfa-Group. The retail sector ranked third, with 22 percent of the total volume. The largest retail deal was the purchase of Nevsky Centre shopping mall in St. Petersburg by PPF Real Estate Russia. The share of multifunctional complexes increased to 6 percent due to the purchase of the development project to include hotel, apartments and retail at 10, Tverskaya Street (JLL advised on the deal).

The share of St. Petersburg remained high, at 23 percdent of the country’s volume in Q1 2019 versus 22 percent in 2018 total. The Moscow share, in turn, increased to 77 percent in Q1 2019 from 66 percent in 2018. In the first three months of 2019 no public deals closed in other regions (outside Moscow and St. Petersburg).

Olesya Dzuba, Head of Research, JLL, Russia & CIS, comments: “We are optimistic about Russia’s real estate investment market perspectives. Among positive factors to note are the rouble strengthening in Q1 2019 and the reduction of inflationary pressure that potentially allows the Bank of Russia to cut the key rate this year. We still expect the 2019 investment volumes to reach USD3.5 billion.”