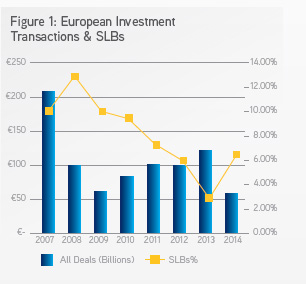

The latest research from Colliers International on the European Sale and Leaseback (SLB) market shows a sudden rise in SLB transactions, accounting for 6.4 per cent of market transactions at a value of €3.8 billion, compared with less than 3 per cent at the end of 2013.

Whilst high levels of SLB activity during the peak of the financial crisis in Europe show that this type of transaction has in the past tended to be contra-cyclical – i.e. more common in tougher economic environments – the recent increase suggests that the economy is not the sole driver, and there are other factors at play, according to the new white paper.

Tim Davies, Head of EMEA Industrial at Colliers International, said, “Sale and Leasebacks were preeminent during periods of financial crisis or poor performance in industry, but corporates are now realising that there are a number of competitive advantages in using these as part of a detailed ownership strategy.

Traditionally, the office sector has dominated SLB transactions over the last two year period, comprising 63 percent of all deals, followed by retail (25 percent), industrial and logistics (12 percent) and hotels. However, Colliers’ report forecasts a shift in appetite reflecting growing investor demand in the industrial and logistics sector, whereby deals being concluded are helping certain operators to expand their footprint and operations, rather than shrink them.

Tim Davies, continued, “We are seeing the biggest movement in corporates exploring a SLB strategy in the industrial and logistics sector, where the traditionally high-income component of industrial properties, relative to other property types, coupled with the e-commerce growth story, means that there is unrivalled interest and new pools of capital coming from overseas points. This includes North American and Canadian pension funds as well as further capital coming out of Europe. These sources are looking for investments in large, good quality industrial portfolios, and in less strong properties with asset management potential.”

Geographically, Germany, the UK and France dominate the list of most active countries with just over 50 per cent of office-based SLB volumes. This is not surprising, given that they have been by far the most liquid investment markets in Europe. Switzerland and the Nordics also feature strongly in the geographic representation, driven by banks’ disposals. Whilst banks have been the main source of office-based deals in the last two years (44 percent of the total), the telecoms and public sector have been other key ‘office-based’ business sectors sources of activity, as well as the manufacturing and automotive sector (13 percent).

For industrial SLBs, the more liquid European markets have been the most active, including the UK with 43 percent of all transactions in 2014, as well as France, Sweden and Finland. There has also been some activity in Europe’s manufacturing and distribution core of Benelux and Germany, but only the one deal to date in Eastern Europe – with the 2014 sale by Bang and Olufsen, of its 16,400 sqm premises in Kopřivnice to Palmer Capital on a 15-year lease contract.

Industrial and logistics property values have improved significantly since 2009, and whilst not quite at their 2008-2009 peak in the majority of markets – they are increasingly attractive to investors owing to the potential for rising capital values in the year ahead, buoyed by yield compression generally and in response to growing occupier demand.

This point is further reinforced with findings reported in the Colliers International ‘2015 Global Investors Sentiment Survey’, which shows that industrial and logistics sector is now one of the top three most popular sectors for investors around the world.