1.5 million sqm of office space was leased last year, which was the best result in the history of Poland’s office market, according to JLL, summarizing the situation on the office markets in Warsaw and the other major Polish cities at the end of 2015.

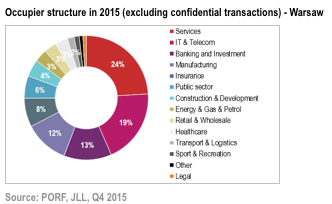

Anna Młyniec, Head of Office Agency and Tenant Representation at JLL, said: “2015 proved to be an exceptional year, recording the highest tenant activity in the history of Poland’s office market. Nationally, lease agreements for approx. 1.5 million sqm were signed with Warsaw accounting for 834,000 sqm of this total. In the capital city, the services sector lead the way with 24 percent share of demand, while IT & telecom companies accounted for 19 percent. Outside Warsaw, the modern business services sector continues to propel market development with a 56 percent share of overall take-up registered in 2015 on major regional markets.”

Warsaw, the largest office market in Poland, witnessed the following take-up. Mokotów (229,300 sqm) and the City Centre Fringe (227,000 sqm) proved to be particularly popular with tenants looking to locate in Warsaw. Last year, the biggest lease agreements were: over 21,000 sqm in Warsaw Spire, PZU (17,500 sqm in Konstruktorska Business Center), mBank (17,500 sqm in Pałac Jabłonowskich), EY (13,500 sqm in Rondo 1) and Aviva (12,000 sqm in Gdański Business Center).

“In our opinion, this robust occupier activity in Warsaw will likely continue in 2016 and 2017,” added Anna Młyniec.

Regional markets on the rise

“Full-year take-up hit 682,900 sqm outside Warsaw with Kraków accounting for 226,000 sqm of this total. One market that has seen a particular turnaround in fortunes is Poznań, which recorded take-up of around 65,000 sqm, more than triple the level achieved in 2014. Numerous companies – both already operating in Poland and newcomers – leased modern space in the Tri-City, Łódź, Wrocław and Katowice, where take up grew by 61 percent, 53 percent, 34 percent and 29 percent y-o-y, respectively. Volumes in 2015 were boosted by exceptionally large lettings – 13 deals of over 10,000 sqm were registered last year outside Warsaw,” explained Mateusz Polkowski, Associate Director, Research and Consulting, JLL.

In 2015, the biggest lease transactions on major office markets outside Warsaw were signed by: mBank in Łódź (24,000 sqm in Przystanek mBank), Shell in Kraków (22,000 sqm in Dot Office), IBM in Wrocław (20,000 sqm in Wojdyła Business Park), Capgemini in Kraków (17,100 sqm in Quattro Business Park) as well as State Street in Gdańsk (15,000 sqm in Alchemia II).

Last year 277,600 sqm of office space entered the market in Warsaw through projects such as Postępu 14 (34,300 sqm) and Royal Wilanów (29,800 sqm).

Furthermore, around 365,000 sqm of new office space was brought to the major markets outside Warsaw. The largest completed projects included Business Garden in Poznań (40,500 sqm), Dominikański in Wrocław (35, 700 sqm) and Alchemia II in Gdańsk (21,500 sqm).

“Currently, nearly 1.5 million sqm of modern office space is under construction in Poland. Warsaw accounts for 700,000 sqm of this sum followed by Wrocław with 184,000 sqm and Kraków with 183,000 sqm. If developers’ plans for 2016 are on schedule, Polish office market may increase by 900,000 sqm in 2016, including 400,000 sqm in Warsaw and 500,000 sqm in other major cities,” said Mateusz Polkowski.

The largest developments scheduled for 2016 are Warsaw Spire A (59,100 sqm) and Q22 (48,000 sqm) in Warsaw.

By the end of 2015, the vacancy rate in Warsaw stood at 12.3 percent (15.8 percent in the CBD, 11.9 percent in the City Centre Fringe and 11.8 percent in Non-Central locations).

Outside Warsaw, the highest vacancy rate was registered in Szczecin (18.4 percent), Poznań (15.9 percent) and Katowice (13.2 percent), while the lowest rates were seen in Kraków (5.5 percent), Łódź (6.9 percent) and Wrocław (8.6 percent).

According to the officefinder.pl, prime headline rents in Warsaw edged down over the course of 2015, with City Centre rents declining from €22–24 / sqm / month to €21–23.5 / sqm / month and Non-Central locations commanding rents of €11–18 / sqm / month. Downward pressures are applicable to effective rents, which are on average 15–20 percent below headline rents (even higher levels of incentives in terms of strategic occupiers may be expected).

Rental levels across core regional office markets levelled off in 2015. Currently, prime headline rents range between €11 to €12 / sqm / month in Lublin and €14 to €14.5 / sqm / month in Poznań, Wrocław and Kraków. Looking ahead, slight reductions in prime headline rents can be expected in 2016.

In 2015, JLL advised in office lease transactions totalling 285,000 sqm in. This accounts for a 25 percent share in overall volume of transactions signed with participation from advisory firms.