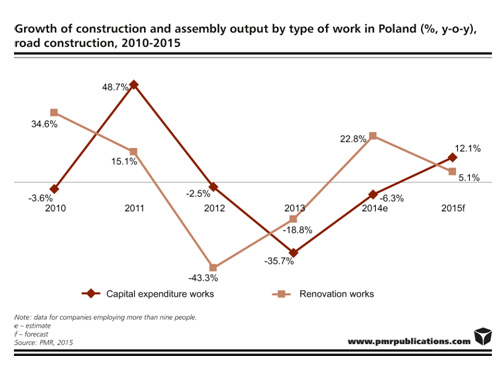

The road construction market in Poland is expected to return to double-digit growth trajectory in 2015 on the back of strong tendering activity in 2013 and 2014. However, given a more even spread of road projects over time, the average annual value of the market will not get close to the record level of 2011 in the 2015-2020 period. Still, a more balanced pace of road construction projects can shield the road construction industry from the drawbacks of the scenario which contractors witnessed in 2012 and 2013.

Following three years of declines, the road construction market will grow by at least 10 percent in 2015, according to PMR’s latest report entitled “Road construction in Poland 2015-2020. Investments – Companies – Statistics – Forecasts – Prices”. However, the current year will only trigger more rapid growth in road construction in 2016.

An analysis of the government’s Programme for the Development of National Roads in Poland suggests that roadworks will peak in 2016-2018, according to the report’s authors. “However, taking into account the developments seen in the previous years and the absence of a fixed target for the sector, as the one represented by Euro 2012 a few years ago, it is possible that road projects will be evenly spread over the next five years and, consequently, the activity in the sector will reach its highest point slightly later, in 2018 and 2019. The scenario would be much more beneficial to the construction industry and it would keep the market safe from a renewed shock,” Bartlomiej Sosna, PMR’s Head Construction Analyst and the author of the reports, said and added: “Given the fact that concrete roads are planned to make an increasing contribution and such factors as falling crude oil prices, renewed sharp increases in the prices of asphalt, such as those that were observed in 2011 and 2012, should not be expected. As of 2015, the recent price drops in the fuel market should start having a positive effect on the profitability of contracts secured in 2014. Lower fuel prices will allow a genuine buffer for contractors which will safeguard the profitability of contracts even if the prices of building basic materials, such as cement or concrete, go up”.

Bartlomiej Sosna also noted that the value of the road construction market calculated as road and bridge construction output generated by all contractors would amount to about PLN 33 billion (€7.9 billion) when road construction works peak. This will be about PLN 5billion (€1.1 billion) lower than the record year of 2011.

An analysis of major tender procedures pursued by GDDKiA in 2014 that was performed for the needs of the report shows that around 90 major contractors were active in the market during the period under review. Budimex was the most active bidder, having taken part in 40, out 43 tenders studied in the report. Other high-ranking contractors in this respect included Strabag, Dragados, Mota-Engil and Astaldi. The most active contractors have tender success rates of about 20 percent. Budimex is a noteworthy example, having won in as many as twelve tenders and showing a tender success rate of nearly 30 percent.

In terms of tendering activity, the Zachodniopomorskie voivodship is the most active region, driven by tenders for the construction of the S6 expressway. The region accounts for 16 percent of the length of roads in the tender phase. Double-digit shares (of about 13 percent) were also recorded by the Kujawsko-Pomorskie (S5) and Dolnoslaskie voivodships (S3). Mazowieckie also achieved a share in the double-digit range, with approx. 100 km of roads in the tender phase.

In a long-term horizon, the most bullish outlook is for road construction in the Zachodniopomorskie voivodship and the eastern regions of Poland (Podlaskie, Lubelskie and Podkarpackie). Roads in these voivodships account for about 50 percent of all high-speed roads planed in Poland. However, not all high-speed roads in these regions are likely to obtain full funding under the current EU’s financial framework effective, and the full completion of the network is not expected until a distant date.