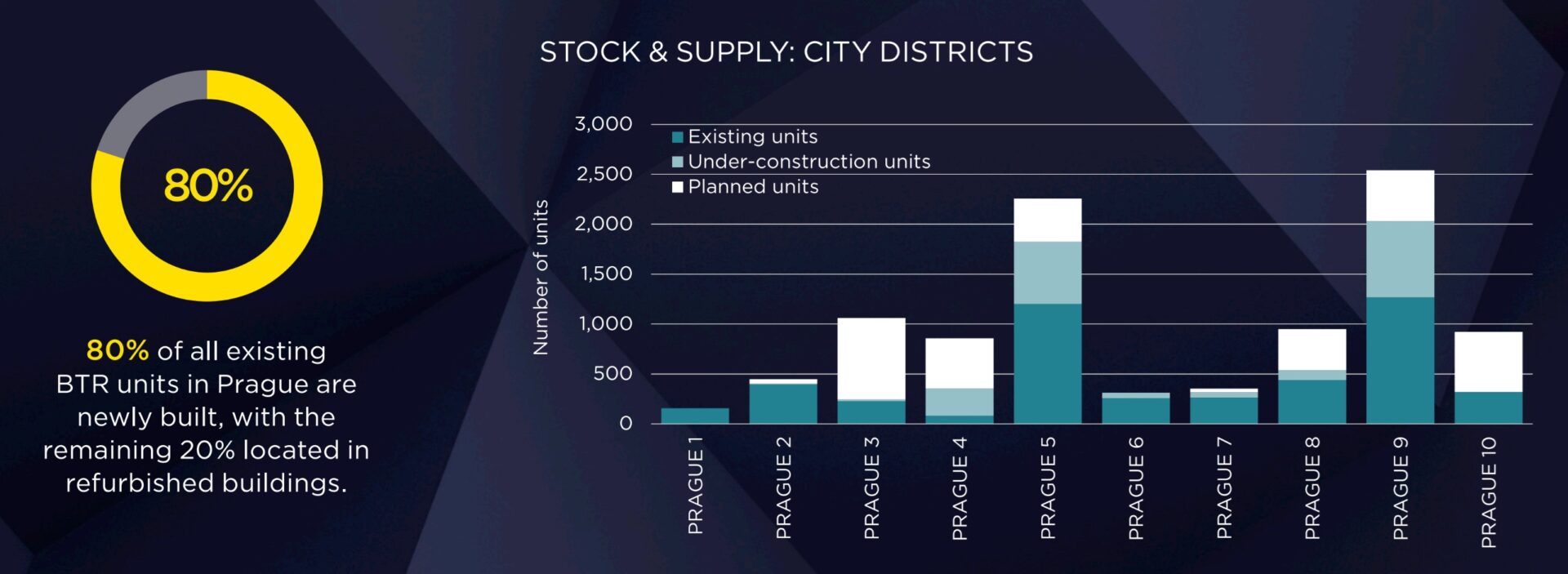

According to the Savills Rental Housing in Prague report, which focuses on the institutional rental housing sector (known as built-to-rent or BTR), there were 4,598 modern rental apartments available in 81 projects across the city as of June 2025. The highest concentration is currently in Prague 9 and Prague 5. More and more people are seeking professionally managed apartments that offer flexibility and a higher standard of service. As a result, most of these residential buildings are fully occupied, with prospective tenants sometimes having to join waiting lists. The largest players on the Prague market include AFI Europe, the Arcibiskupství pražské (Archdiocese of Prague), and Zeitgeist Asset Management.

Marek Pohl, Head of Valuation at Savills, says: “From a long-term investment perspective, rental housing represents an attractive and stable asset. In addition, it offers flexible exit strategies, including the option of gradually selling off units individually. Projects located in central urban areas are particularly appealing to young tenants who would otherwise be unable to afford homeownership in these locations. This makes rental housing not only an appealing investment opportunity but also an important tool for ensuring housing affordability in metropolitan areas.”

“After a record year in 2023, when 894 units were completed in Prague, the pace has slowed, with 782 units added in 2024 – a 13 percent decrease. In the first half of 2025, another 448 units were delivered, but we expect a further slowdown in the second half of the year. Nevertheless, the sector is still growing significantly faster than it did before 2021,” adds Lenka Pechová, Senior Research Analyst at Savills.

Most projects remain small in scale

Out of a total of 81 residences, 70 percent have fewer than 50 units. Only 14 projects offer 100 or more units. The most common layouts are studios and one-bedroom apartments (1+kk and 2+kk), which together account for nearly 80 percent of the market. Larger layouts remain limited, with two-bedroom units (3+kk) making up 18 percent and three-bedroom units (4+kk) just 4 percent.

Prices for smaller units remain stable, and larger apartments see price increases

While the average monthly rent excluding service charges has remained stable for smaller units (CZK 19,900 for 1+kk and CZK 27,400 for 2+kk), rents for larger units have increased by up to 15 percent year-on-year. For example, a 3+kk apartment now rents for an average of CZK 43,000 per month, and a 4+kk for up to CZK 68,000.

Positive outlook for rental housing in Prague

“In 2026, over 1,100 units are expected to be completed. Currently, 1,902 units are under construction, and another 3,400 are set to begin construction within the next two years,” says Lenka Pechová from Savills. Despite the temporary slowdown in completions, the outlook remains positive. Investor interest is growing, and new projects are entering the pipeline. The BTR sector is becoming an established part of Prague’s residential market and is raising the standard of rental living in the city.