Almost a third of European retailers view Africa as an important future destination in the next three to five years, reveals leading real estate advisor, CBRE.

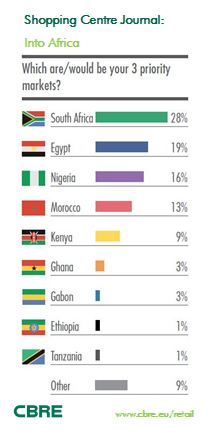

In a recent report, CBRE surveyed the expansion plans of 115 leading retailers. Over the next five years, a third see Africa as extremely or very important retail destination with 28 percent of respondents viewing South Africa, Egypt (19 percent) and Nigeria (16 percent) as key priority markets.

Across the region, quality of retail space is increasing dramatically with the 115,000 sqm Mall of Africa opening next year in South Africa, Muxima Shopping in Ghana and the Palms in Nigeria. There are assets relevant to all retailers, from value-priced fashion to ultra-luxury.

64 percent of respondents went on to say that franchise stores would be their preferred route to market, and the two areas stopping them from expanding more rapidly into Africa was infrastructure (22 percent) and easier opportunities elsewhere (21 percent).

Andrew Phipps, Head of Retail Research and Consulting, CBRE EMEA said: “South Africa is likely to remain the number one choice of destination due to the presence of the elements retailers want to see: the infrastructure, number of quality shopping malls and the existing presence of brands being the strong indicators new entrants will look for. There is certainly appetite for international retailers to enter the market. The challenge is finding the right partner that understands the market as well as the retail brand.

“In terms of infrastructure, there have been significant levels of investment into standby power, wayfinding and parking as developers contribute heavily towards or upgrade the infrastructure themselves. Investment in existing malls is also taking place with many undergoing major refurbishments and modernisation.“

Though some investors are looking further afield into second tier cities, Lagos is still a major focus for retailers keen on the Nigerian growth story. As of Q3 2015, for every 200 people in Lagos only one square metre of formal retail space was available, compared to one sq m or retail for every person in Johannesburg. This large defecit, together with with rapid urbanisation rates and a population over 17 million has since attracted a number of local and international investors keen on providing formal retail in this growing city.

Retail development activity today is concentrated in and around Lagos as well as the capital city of Abuja. In Lagos alone there is presently around 270,000 sq m of new space in development, of which around 60 percent is under construction. Two projects of note are Festival Mall, which opened in Q3 2015, and Circle Mall, which will be completed by the end of 2015. Both offer around 11,000 sqm of retail space. The 22,000 sqm Lekki Mall is another significant scheme in progress in the Lagos area.