Colliers International has analysed the impact of the mass recall of bank licenses by Bank of Russia in the street retail sector. Because of the regulation, 517 bank branches have closed in Moscow, which is 17 percent of the total amount of bank branches within the Moscow street retail market. Given that the average bank branch size is 150-200 sqm, this means 70,000-100,000 sqm of vacated space.

The number of bank premises within the total amount of street retail is hardly critical; therefore, at the start of the license recall process, its impact on street retail was almost imperceptible – it was mainly a matter of recalling licenses from small banks that did not have a large branch network. However, as the process continued, the number of branches closed became significant.

Bank facilities are located both in dormitory communities and in the centre of Moscow. And despite the fact that the highest volume of these premises on the central shopping corridors is occupied by the top banks (such as VTB 24, Sberbank, Alfa Bank, Bank of Moscow, CitiBank, etc.) a number of banks that have had their licenses recalled (for example, SB Bank, Russian Credit, Transnational Bank) also had quite an extensive branch network. Therefore, as a result a number of branches have closed in the city centre. After the license recall and closure of branches at the beginning of 2015, in some cases the vacated premises were quickly leased to other banks. For example, Mir Bank occupied many of the former premises of SB Bank.

While in 2015 the main reason for the closure of branches was associated with the recall of licenses, we are now observing a reduction in the number of branches active banks that had a stable presence on Moscow’s main shopping streets. This is because banks are gradually optimising their branch networks and reducing the cost of leasing and maintaining offices by enlarging and re-distributing branches. The average area of vacated premises of major bank branches is roughly 300 m2. For example, Sberbank has vacated premises on Ostozhenka and Zemlyanoy Val, and CitiBank Bank’s premises on Tverskaya Street are also empty now. Some banks, such as OTP Bank, Strategiya, IV Bank, Raiffeisen Bank, Rossiisky Capital and Otkrytie, have also reduced their square meterage in central Moscow in the past year and a half.

The vacated premises were not re-occupied rapidly, since the conversion of a bank branch for use by a different type of tenant requires time and additional investment. Therefore, very often another bank came to occupy the premises of the closed one. Thus, Gazprombank occupies the former premises of Renaissance Capital on Bolshaya Yakimanka, PIR Bank replaced Probusinessbank on Novinsky Boulevard and Absolut Bank is now at the location of the former Rossiisky Credit bank.

Examples of other types of tenants are food service outlets (which lease more premises than all the other types), flower shops, beauty salons and small grocery stores. For example, the Crabster cafe is now located on Arbat in the premises vacated last year by Investitsionny Soyuz bank after it lost its license. The former premises of Transportny bank are now occupied by a perfume and cosmetics store, Novaya Zarya – Nouvelle Etoile, on Nikolskaya Street, and the ETRO Makeup beauty salon occupies the former premises of Mezhtrustbank Bank on Sadovaya-Samotechnaya; however, tenants have yet to be found for at least half of the vacated bank premises.

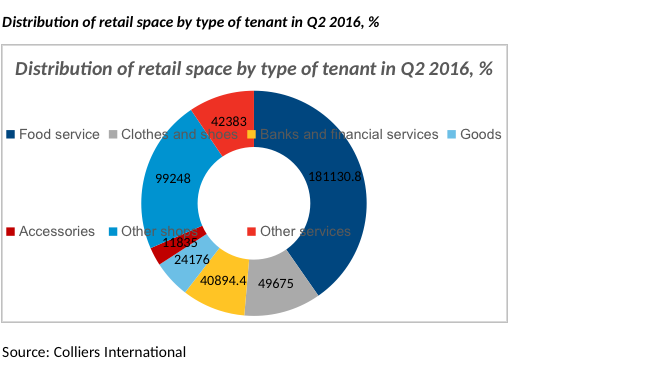

The share of banks in the total amount of leased premises in central Moscow in H1 2016 is 9 percent. If we trace the trend of occupying former bank premises in the autumn of 2015 (the last eight to ten months), we see that given the supply in early 2016 of 51 former bank premises, about half were still available for rent at the end of the Q2. Of the remaining premises, 10 have been leased by food service companies, 5 by other banks, and the rest have other types of tenants (pharmacies, beauty salons, a florist, mobile phone stores, household goods stores, etc.). A number of vacant premises have been on the market for almost a year.

Nikolay Kazanskiy, managing partner of Colliers International Russia, commented: “Given that in the overall structure of tenants in central Moscow, banks occupy approximately 9 percent of the premises, the recall of licenses from banks as a whole has had a moderate influence on the Moscow street retail market. However, in conjunction with the ongoing optimisation of existing bank branch networks, this effect has been amplified. According to various forecasts, in the next few years the license recall will continue, but not to the extent of previous years, since a significant portion of non-viable banks has already been closed. However, 2016 will still affect the overall situation in street retail and it is expected that an additional 10 percent of banks will have their licenses recalled, which is about 75 banks. Judging from the trend of the first five months, these forecasts are quite feasible, and the trend will lead to the appearance on the market of new supply in street retail, which will be interesting for tenants in other sectors.”