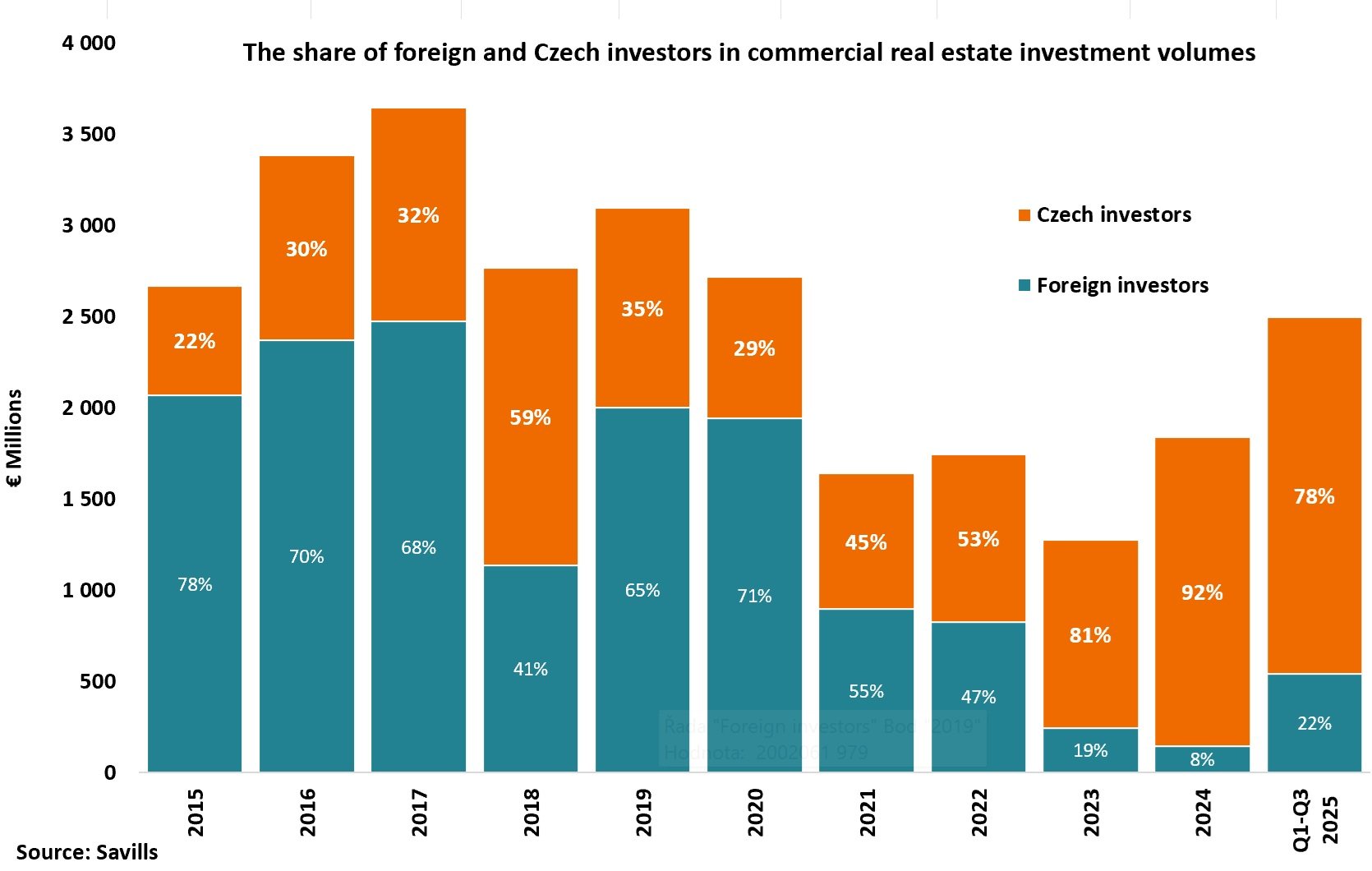

According to Savills’ analysis, investment activity in the Czech commercial real estate market is now primarily driven by domestic capital. In the long-term trend, local capital accounted for one-third of the total investment volume. Over the past three years, however, the balance has shifted dramatically – this year, Czech investors represent as much as 80 percent of all transactions completed to date. Moreover, Czech investment groups are no longer just local players; they are becoming respected investors across Europe.

“By the end of the year, we expect the share of Czech investors to increase to as much as 90 percent. They have tremendous strength, confidence, and the capability to execute large-scale transactions. They are no longer passive seekers of investment opportunities but have become sought-after partners, actively acquiring assets throughout Europe,” says David Sajner, Investment Director at Savills.

Why Czech investors hold such a strong position on the market

The Czech real estate market did not experience as steep a price decline during the COVID-19 pandemic as Western Europe did. As a result, many foreign investors are now more inclined to sell their Czech assets rather than expand their local portfolios. This combination of a broad supply and limited foreign competition creates an opportunity for domestic players to acquire high-quality assets under attractive conditions in a market they trust and know best. Consequently, current investment activity is driven primarily by domestic capital, which accounts for up to 80 percent of total transaction volume.

Investment funds manage the capital of Czech investors who prefer to invest “at home” – in an environment their portfolio managers know well, where they can accurately assess risks and understand both tenant behaviour and market dynamics. “People want to see where their money is going; they want to walk past the buildings they co-own. Domestic funds have an in-depth knowledge of the market. Foreign investors, on the other hand, have to factor in a risk premium, which often makes them less competitive on price,” explains David Sajner.

Why investors choose to invest in the Czech Republic

- A stable market with limited fluctuations – property values did not decline as sharply as in Western markets.

- Rising rents are driven by low construction activity, resulting in demand exceeding supply.

- Property value growth is driven by rent indexation to inflation, which has increased rents by roughly 25 percent over the past two years.

- Strong capital inflows into local real estate funds, as investors move their money from savings accounts due to declining returns.

- Excellent local market knowledge among domestic portfolio managers, leading to higher confidence in the Czech market and lower perceived risk premium compared to their counterparts from foreign funds.

In recent years, some Western European funds have faced investor outflows, often requiring them to recapitalise through asset sales. Where liquidity may be limited in their home markets, they are likely to find a deeper buyer set in the Czech market, which will support reasonable exit pricing.