Retail properties showed the strongest growth in capital values and rents of all property types globally in Q3 2013, according to the CBRE Group.

“Commercial real estate capital values generally rose faster than leasing fundamentals across all property types in Q3 2013, reflecting several capital markets trends that have been prevalent for some time,” said Dr. Raymond Torto, Global Chairman, CBRE Research. “First, returns in commercial real estate have been very strong relative to other major asset classes, attracting institutional capital sources to the sector. Second, the number of assets available for sale remained relatively limited. Finally, commercial real estate fundamentals are expected to improve and catch up with capital markets demand as regional economies continue to recover. This optimism is buttressed by the lack of new construction resulting in a tight leasing availability, especially in mature commercial real estate markets.”

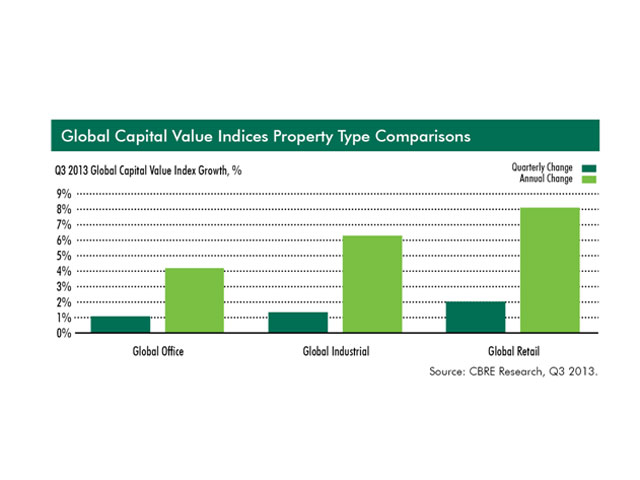

The CBRE global capital value indices showed gains on both a quarterly and annual basis for all property types. The indices highlight the fact that capital flows—rather than market fundamentals—remained the main growth driver for commercial real estate. This trend has been in place for several years as commercial real estate’s earning multiple has risen faster than property earnings. The CBRE Global Retail Capital Value Index showed the strongest growth among property types, rising 2 percent during the quarter, and by 8 percent year-over-year. During Q3 2013, the Global Industrial Capital Value Index rose 1.4 percent, and the Global Office Capital Value Index rose 1.1 percent. Regional capital values rose most strongly in the Americas, which saw growth of almost 7 percent on an annual basis.

On a global basis, rents reflected positive, but slowing growth across all property types. The CBRE Global Retail Rent Index fared best, rising more than 1 percent during the quarter and by 4 percent year-over-year. Rising retail rents reflect limited space availability and increased demand from retailers who need to position their shops and are attracted to prime space. Meanwhile, office rents were virtually unchanged, and industrial rents improved less than 1 percent during the quarter. In the office sector, the Americas, dominated by U.S. markets, posted the strongest rent growth. A contributing factor in this growth has been the historically low levels of new office construction.

Valentin Gavrilov, Director of the Research Department in CBRE, Russia, said: “Real estate capital value growth by 4-8 percent p.a. confirms that investors are positive about the world economy growth perspectives. As is typical for the asset markets, investors take decisions on the basis of expectations rather than on fundamentals. As a result, increase in capital values has its sources in capital flows rather than in strengthened leasing activities and growing rents. European macroeconomic indicators remain quite fragile despite some positive trends. In Russia retail property remains the most interesting target for investment in commercial real estate due to the solid consumer demand and growing rents in the most popular retail schemes in 2013. Expectations for 2014 remain rather positive though significantly worse compared to that as of half a year ago.”