After a temporary slowdown, the modular construction market in Poland continues to expand in 2025. Although the sector faces challenges such as high material costs and investment financing, the fundamentals for the sector’s development remain solid. By 2031, the value of the modular construction market in Poland could increase by more than half. With the development of technology and the growth of 3D prefabrication capabilities, modular construction is finding increasingly wider application in new specialised segments of the construction industry.

The modular construction market has slowed down

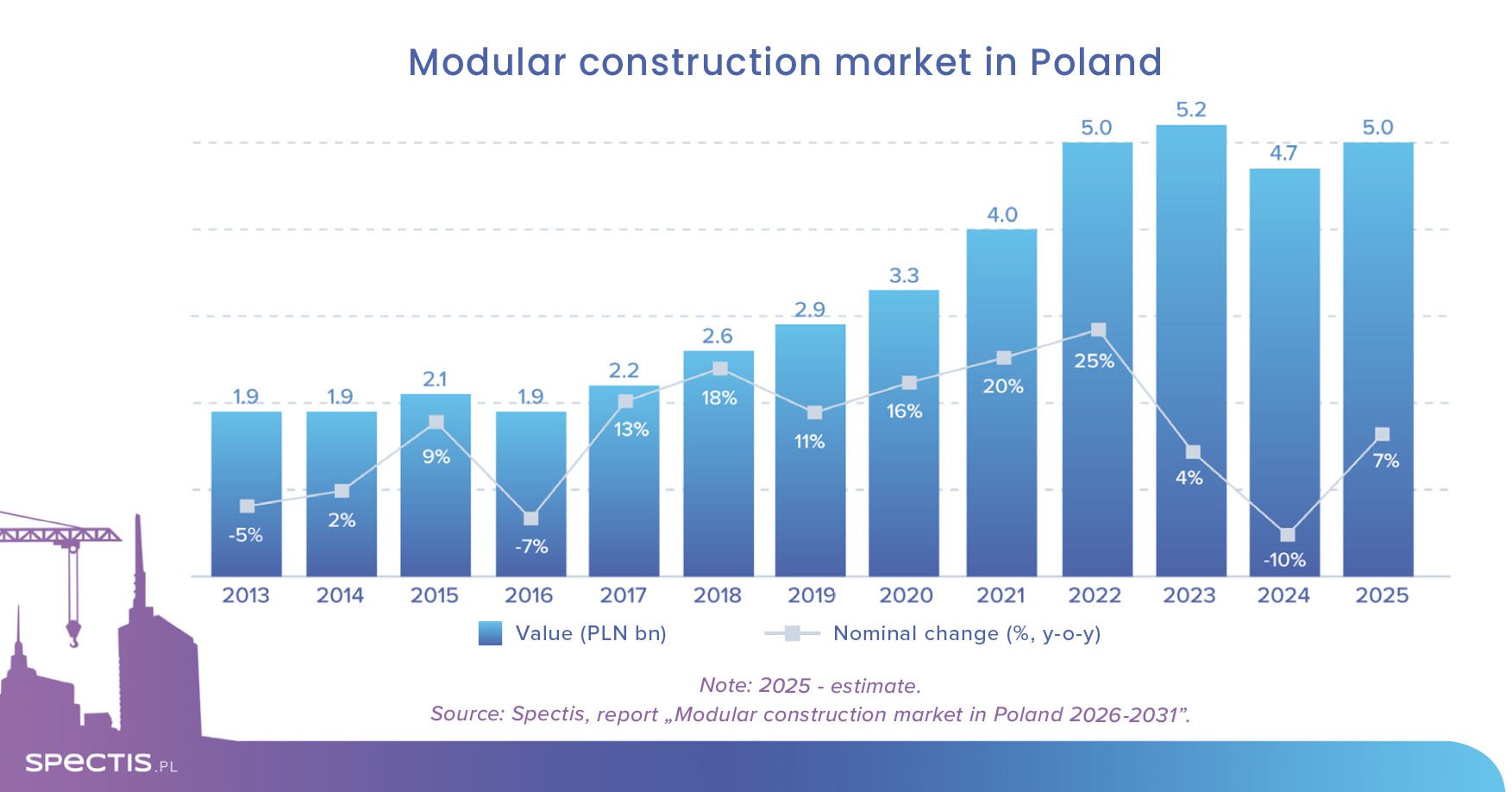

Top 150 manufacturers of prefabricated buildings made of wood, steel, concrete, or LECA generated revenue of PLN 12.5 billion in 2024, with more than 37 percent of the figure contributed by sales in the modular building segment, according to the report released by research firm Spectis, “Modular construction market in Poland 2026-2031”. This equates to a market value of approximately PLN 4.7 billion. Based on preliminary data, Spectis analysts estimate that in 2025, the market value grew by 7 percent in nominal terms to a level of PLN 5 billion.

Positive outlook despite temporary slowdown

In 2025, single-digit growth in market value is expected. The primary drivers of this improvement will be the recovery in the residential construction market, as well as the implementation of investments from the National Recovery and Resilience Plan by 2026. This plan includes support for the construction sector, particularly investments in eco-friendly, modern, and energy-efficient solutions.

All indications suggest that in the coming years, modular technologies will gain prominence in both commercial and public construction. The market outlook remains moderately optimistic, and the combination of the factors mentioned above means that by 2031, the value of the modular construction market in Poland could increase by more than half compared to 2024 levels. This is a clear signal that the future of Polish modular construction is shaping up to be exceptionally bright.

More and more new players are entering the modular construction market

The last two years have seen a sharp increase in the number of new manufacturers, both entities that are building module factories from scratch and companies with an established position in traditional construction that are entering the prefabrication segment. This prompted the authors of the report to expand the base of companies analysed in the report from 100 to 150.

This is a natural stage in the development of the industry: more and more companies are recognising the potential of modular technologies, entering the market with their own innovations and filling niches that were previously overlooked. Technological developments and access to new know-how are lowering the barriers to entry into the prefabrication market, which further supports its diversification. The result of this phenomenon is greater competitiveness, a faster pace of innovation and a more diverse offering for investors and developers.

This is a beneficial trend for the development of the entire industry. Prefabrication is no longer the domain of a few leaders and is becoming a viable, scalable alternative to traditional construction. The more high-quality market participants there are, the faster the entire sector gains in importance.