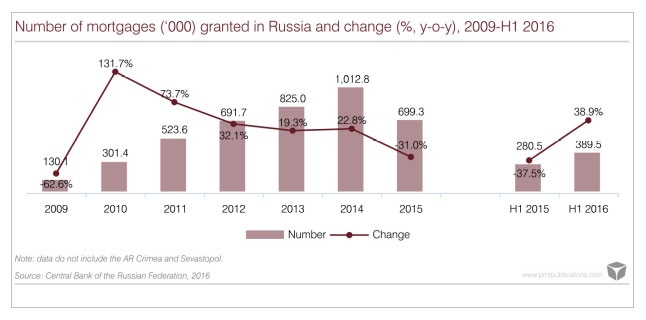

After a period of impressive double-figure growth rates between 2010 and 2014, with all-time record number of mortgage loans granted in Russia in 2014, the mortgage market collapsed in 2015. Nevertheless, in 2016 the market is predicted to recover most of last year’s losses.

There was recorded a 31.7 percent contraction in mortgage approvals in Russia last year, despite the fact that in March 2015 the government approved some support for the mortgage market, by subsidising mortgage interest. It is estimated that without the government’s decision on mortgage interest rate subsidies, this collapse could have exceeded 52 percent. A total of about 210,600 loans were granted within the mortgage support programme in 2015 (30 percent of the total in Russia) at a total value of RUB 1,161bn (€17.2bn). Nevertheless, it is worthy of note that the effect of the mortgage market on residential construction activity in Russia has been constantly growing, but still it is less crucial than in developed countries. The ratio of mortgage debt outstanding to GDP expanded to only 4.94 percent in 2014, the highest figure on record, but decreased to 4.92 percent in 2015.

In 2015, mortgages granted by banks across the country were worth RUB 1,161bn (€17.2bn) in total, of which 57.7 percent was accounted for by Sberbank (52.3 percent in 2014 and 46.5 percent in 2013) and another 17.3 percent by VTB (19.9 percent in 2014 and 18.0 percent in 2013). The market shares of Sberbank slightly decreased in H1 2016, when the total value of mortgages granted was RUB 664bn (€8.5bn), of which 50 percent was accounted for by Sberbank and almost 20 percent by VTB24.

The sharp decline in the mortgage market in 2015 was caused mostly by the 4 percent contraction in the real disposable income of the population, and the shortage of long-term resources in the banking industry. Sberbank and the VTB Group control more than 70 percent of the mortgage market in Russia, but since July 2014 these lenders, along with several other state-controlled banks, have been gradually cut off from raising long-term international funding. Furthermore, the negative impact of the reduction in real disposable income was amplified by an increase in the cost of mortgages. In 2015, the interest rate on mortgages hovered between 12.3 percent and 14.7 percent, for few months reaching cost levels not seen since 2006 and 2009, whereas between 2011 and 2014 it fluctuated between 12 percent and 13 percent.

Despite the fact that in March 2015 the government approved some support for the mortgage market, mostly by subsidising mortgage interest, this was far from sufficient to avoid a double-figure contraction in mortgage approvals in Russia last year. In March 2015 the government decided to offset the proportion of the interest rate on mortgage loans in excess of 12 percent (with the borrower supporting 12 percent and the state making up the difference).

However, even though the mortgage support incentive was approved on 13 March 2015 and was fully operational since April, banks in Russia granted only less than 67,500 mortgage loans to population each month during April-November 2015, which was not markedly more than the result achieved in the first two months of the year: 43,020 awarded in January and another 49,037 loans were granted in February. The approval process increased markedly in December, with 105,177 mortgages being granted in Russia during the month, but still 19.3 percent fewer loans were approved than in December 2014.

As indicated in the chart above, without the government’s financial support channelled to offset the proportion of mortgage interest rates in excess of 12 percent, the mortgage market’s collapse could have exceeded 51 percent in 2015. According to the Central Bank, almost 699,300 mortgages were granted in Russia in 2015 (1.01 million in 2014), of which 210,633 loans were subsidised loans. Given all the above mentioned factors, it is evident that the decisive factors in terms of the mortgage market’s collapse last year were the shortage of long-term resources in the banking industry and sizeable contraction in real personal income.

In 2016, the mortgage market is set to resume growth, with a double-figure increase in the amount of mortgage approvals very likely to be achieved this year. PMR estimates that 900,000-950,000 loans will be approved, at a predicted total value of RUB 1,500-1,600bn (€20bn).

The rebound will be fuelled by:

-

less expensive lending costs (when compared to 2015). The Central Bank’s key rate has been considerably reduced since the beginning of 2015, from 17 percent in January 2015 to 10.5 percent by August 2016. In H1 2016, mortgage loans were granted with an average interest rate 12.7 percent, whereas in H1 2015 the figure was 14.0 percent.

-

very low default rate

-

relatively low proportion of payments more than 31 days overdue (3.7 percent in July 2016, against 2.6 percent in February 2014)

-

in February 2016, the Russian government decided to extend the state mortgage subsidy programme until the end of 2016. The government will continue to offset the proportion of mortgage interest rates in excess of 12 percent, though the budget allocated for this incentive was not increased.