JLL’s logistics and industrial occupier survey, conducted in co-operation with CoreNet Global, the world’s leading association for corporate real estate, confirms that the major drivers impacting on the sector will remain unchanged over the next five years from previous years.

According to the survey, e-commerce/multi-channel retail will remain as the main growth enabler, followed by emerging markets and new technology implementation. Despite the improving global economic outlook the results of the survey highlight that significant pressure to reduce overall costs remains. Over the next few years companies will increasingly seek to cut transport costs through location strategy, for example by moving closer to their customer base.

Almost two thirds of respondents expect to increase their logistics floorspace over the next three years. As a result, JLL projects annual take-up to remain on similar strong levels as in recent years. “Space requirements will be mainly driven by network re-alignment to service new customer demand patterns, in particular a seamless combination between online/offline and increase the speed of delivery. Occupiers will require more large facilities including mega-sheds exceeding 100,000 sqm to support this demand.” comments Alexandra Tornow, Head of EMEA Logistics & Industrial Research at JLL.

Companies will also place high importance to further integrating electrical power reduction, heating energy reduction and renewable carbon power generation into their real estate sustainability agenda. By contrast, risk prevention measures such as overheating mitigation and reinforcements to the roof to cope with extreme weather are still not widely regarded.

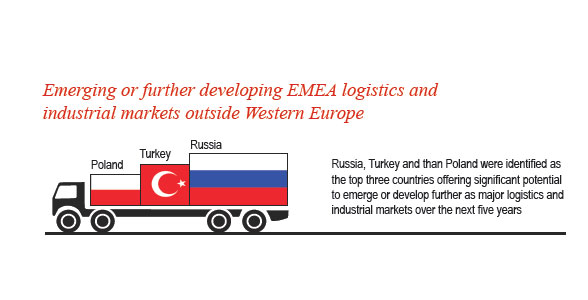

According to the survey – which closed ahead of the recent political developments – Russia and Turkey will be the emerging markets providing the strongest growth opportunities. Alexandra Tornow, commented: “There are long-term growth expectations in Russia and Turkey. Nevertheless, these markets continue to present companies with a range of real estate risks and challenges such as high land prices and long processes to obtain planning permission. Furthermore, recent events are likely to temper corporate activity at least over the short term.”

“Rapidly changing logistics and industrial markets across Europe will provide occupiers, developers and investors with significant opportunities to respond to local markets, led by changes in demand from consumers of manufacturing and industrialised products. However, significant challenges remain in these locations. To stay ahead of the curve, real estate markets will have to be bold and responsive to the opportunities created by changing transport infrastructure corridors, locational dynamics and consumer demand. The key challenge for developers, investors and especially occupiers will be how to best provide the right type of property product and lease term to enable them to take advantage of demand in these rapidly changing markets,” Matt Bigam, CoreNet Global concluded.