The majority of retail space in the pipeline is being developed in major agglomerations. The value of retail investment transactions totalled €1 billion in H1 2016, according to JLL summarizing H1 2016 on the retail market in Poland.

By the end of H1 2016 modern retail stock in Poland totalled 13.07 million sqm across the following formats: 9.3 million sqm (71 percent) in shopping centres, 3.57 million sqm (27 percent) in retail parks and warehouses; and 0.21 million sqm (2 percent) in outlet centres.

“In total, the Polish retail market gained 115,800 sqm of new space in H1 2016. The biggest shopping centres delivered to market since the beginning of the year include Galeria Glogovia in Głogów and Galeria Karuzela in Września,” said Anna Bartoszewicz-Wnuk, Head of Research and Consulting at JLL.

The retail market grew by some 91,300 sqm in Q2 2016 across all formats. New projects delivered in Q2 include: Galeria Karuzela (12,000 sqm) in Września, Galeria Awangarda (6,000 sqm) in Bartoszyce, Galeria Zaspa (8,800 sqm) in Gdańsk, as well as the extensions of Morena (+6,000 sqm) and Auchan (+3,000 sqm) in Gdańsk. Additionally, three Leroy Merlin DIY stores (approximately 39,000 sqm) commenced operations in Wrocław, Jelenia Góra and Konin; Agata Meble opened in Częstochowa (10,000 sqm); and a retail park of 6,500 sqm – next to Galeria Leszno in Leszno. However, CH Sosnowiec (16,700 sqm) was the first example of a shopping centre being closed in Poland, due to the termination of the lease agreement with its main anchor – a hypermarket operator (Real).

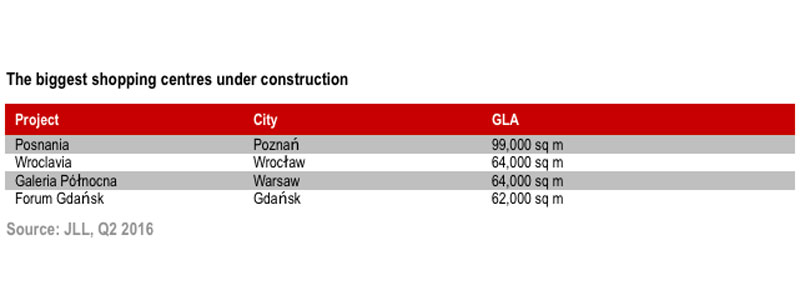

More than 610,000 sqm of retail space is currently at the development stage, half of which is expected to enter the market in the remaining part of this year. Shopping centres account for the majority of retail space under construction.

65 percent of the 2016 shopping centre pipeline (already delivered to market or with completion scheduled for H2 2016) is to be found in the major agglomerations, while the remaining 35% is in cities of below 100,000 residents.

Due to the aging of shopping centres, a rising trend is to refurbish, remodel and/ or extend existing asset. One of the centres that has recently been refurbished is Galeria Zaspa in Gdańsk which was remodernized and reopened in Q2 2016.

“The Polish market, due to its considerable size, continues to attract new international retailers. In Q2 2016, American U.S. Polo Assn. opened its first mono-brand store, and the global fashion giant Hennes & Mauritz announced the opening of its first & Other Stories store in Warsaw in December 2016. Furthermore, the first mono-brand boutiques by Steve Madden are scheduled for launch by the end of the year,” said Mariusz Czerwiak, Associate Director, Retail Agency, JLL.

At the same time, French fashion retailer Celio, due to its international strategy, withdrew from the Polish market.

“Some changes to the legal environment of the retail market in Poland are planned in the short and mid-term. The Retail Tax Act is expected to come into force in autumn 2016. The tax will be imposed on retail sales (exclusive of VAT). However, retail sales made via the internet (e-commerce) will not be taxed. Based on the initial information provided by the government, the tax will impact approximately 100 major retailers operating in Poland,” commented Anna Bartoszewicz-Wnuk.

Prime rents, which refer to shop units of 100 sqm earmarked for fashion & accessories and located in the best-performing assets, are traditionally higher in Warsaw (€130 / sqm / month). Rents in other major agglomerations average out at between €45-€55 / sqm / month.

Agnieszka Kołat, National Director, Retail Investment CEE, JLL, commented: “The volume of retail investment transactions in Q2 2016 amounted to approximately €893 million, which is more than eight times higher than the value recorded in the corresponding period of 2015. This is mainly attributable to one record-breaking transaction: Redefine’s acquisition of a 75 percent stake in the Echo Investment commercial platform in Poland including retail assets such as Amber in Kalisz, Galaxy in Szczecin, Galeria Echo in Kielce, Galeria Olimpia in Bełchatów, Outlet Park Szczecin, Pasaż Grunwaldzki in Wrocław, CH Echo in Przemyśl and Bełchatów, Galeria Sudecka in Jelenia Góra and Galeria Veneda in Łomża. In total, investment transactions worth over €1 billion were concluded on the Polish retail market in H1 2016.”

Other notable Q2 retail deals included the acquisition of the Ferio Konin shopping centre by Union Investment for an undisclosed price and the sale of Jantar in Słupsk to CBRE Global Investors for €92 million.

“There are also other transactions at advanced stages that are expected to be concluded later in the year. Furthermore, a number of new retail investment opportunities were brought to the market in Q2 2016, either as portfolios or individual assets. The outcome of these sale processes will be known in the next few months but, given the strong demand for retail investment products, we believe these opportunities will find buyers,” added Agnieszka Kołat.

Prime shopping centre yields remained stable in Q2 with best-in-class products expected to trade at 5.0 percent.