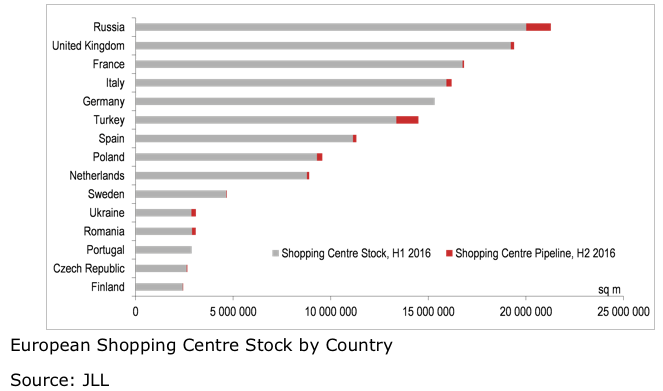

According to JLL estimates, in 2016, some 1.9 million sqm of new quality shopping centres can enter the Russian retail market. About 437,000 sqm was completed in H1 2016 (42 percent down y-o-y). As a result, the total Russia stock will rise to more than 21 million sqm by the end of the year, which is the highest level in Europe.

In terms of total stock, the top five European retail markets also include the UK (19.2 million sqm at the end of 2016), France (16.8 million sqm), Italy (15.9 million sqm) and Germany (15.3 million sqm). Ukraine and Romania’s retail markets share the 11th place, each with 2.9 million sqm of quality retail stock.

The largest Russian regional cities by retail stock include Yekaterinburg (730,000 sqm), Krasnodar (670,000 sqm), Samara (549,000 sqm), Nizhniy Novgorod (524,000 sqm) and Chelyabinsk (430,000 sqm). For comparison, at the end of H1 2016, Moscow stock accounted for 4.9 million sqm, St. Petersburg stock – 2.2 million sqm. By the end of the year, the major regional completions are expected in Samara and Tyumen, where total stock will grow to 664,000 sqm and to 464,000 sqm respectively.

“Despite the large completions volume, shopping centre density in Russia remains rather low, about 140 sqm per 1,000 people, which is comparable to the Turkish developing market,” Ekaterina Andreeva, Investment & Retail Markets Analyst, JLL, Russia & CIS, commented. “At the same time, the leader in quality shopping centre stock density in Europe is Luxembourg, due to its small population, with 618 sqm per 1,000 people. Still, total stock in this country is the lowest. The Netherlands ranked second with 517 sqm per 1,000 inhabitants. The density in the UK stays at 293 sqm per 1,000 people, in France – 251 sqm per 1,000 people and in Germany – 186 sqm per 1,000 people.”

In H1 2016, the leader in shopping centre density in Russia remains Krasnodar, with 808 sqm of quality premises per 1,000 people. Yekaterinburg (532 sqm) and Samara (468 sqm) follow it. For comparison, St. Petersburg density accounts for 417 sqm, Moscow – for 394 sqm.

By the end of the year, Tyumen and Samara will be ahead of Yekaterinburg by shopping centre density. Due to the total completions in Tyumen this indicator will rise from 441 sqm per 1,000 people to some 600 sqm. After Good’ok shopping centre enters the market, Samara will stay at the third place, with 566 sqm of quality malls per 1,000 people.

“The bulk of shopping centre supply is coming in Russian cities with population of less than 1m people – 51 percent of the total completions are expected there; 32 percent share is expected in Moscow and Moscow region. It is important that the development of these malls started to construct while the economy was stable and the market grew actively,” commented Anton Korotaev, National Director, Head of Retail Strategic Consulting, JLL, Russia & CIS. “In 2011-2013, developers focused not on Millionniki but on smaller cities with low retail density and relatively high level of purchasing power.”

“Today, despite the increasing shopping centre density in Russian cities, there is still a potential for further development, as the existing stock is not sufficient in some locations. However, the projects are better to be developed after recovery of the economy. In the current situation development of new malls in regional cities is not financially attractive, due to the expensive financing, low rental levels and the fact that many retailers are not ready to open their stores in Russian regions,” Anton Korotaev concluded.