From Q1 2023, Savills registered around 1.4 million sqm of industrial space intended for lease that is in various phases of construction. These construction levels were also true in Q2 2023, representing the highest volume in the history of the Czech industrial market. At least 60 percent of this space, almost 833,000 sqm, is already pre-leased. Most of this pre-leased industrial space is being built for tenants from the manufacturing sector (38 percent), followed by retail (30 percent) and logistics (16 percent). The largest property under construction is a build-to-suit hall for the retail chain H&M.

Jana Čožíková, Associate Industrial Agency at Savills, says: “The high activity of developers and record construction levels are positive signs. These factors do not only affect industrial and logistics rents, where we are already registering a small year-on-year decline but also vacancy rates, which are up year-on-year. The market’s confidence in new construction creates ideal conditions for the arrival of new tenants, as well as for the potential growth of well-established companies. This confirms the old rule that “supply creates demand”. The great news is also the quality of tenants across the manufacturing, retail and logistics sectors.”

The largest volume of space underway in June was seen in the Karlovy Vary region, reaching almost 336,000 sqm. The reason is the construction of a new logistics centre for H&M (233,700 sqm) and the construction of a distribution centre for Goodyear (60,600 sqm), which is built at Panattoni Park Cheb East. The commitment signed by H&M is also the largest lease transaction in the entire history of the Czech industrial leasing market.

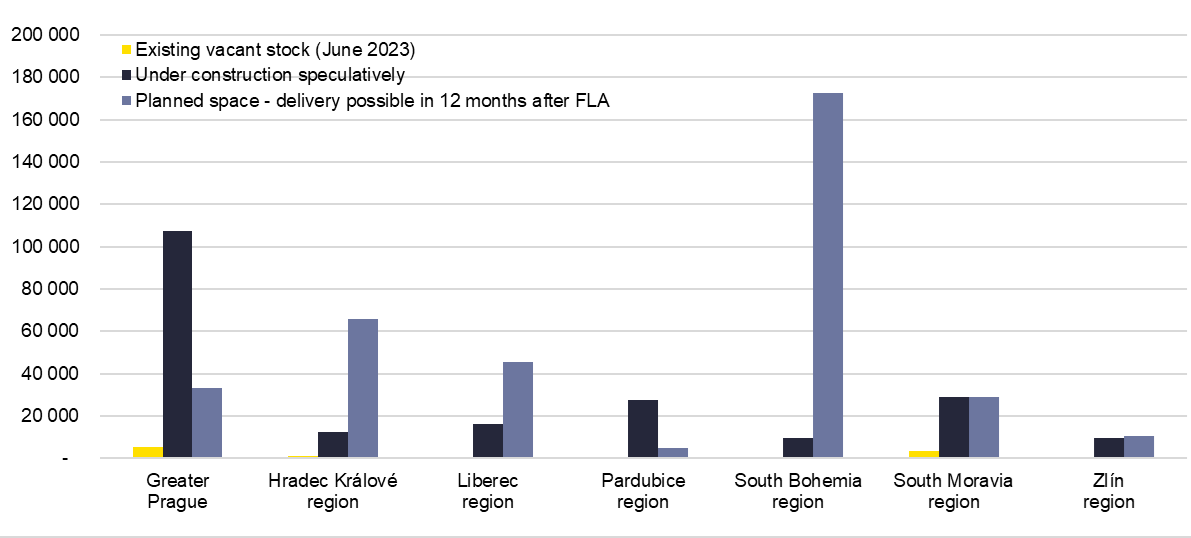

Construction of industrial space in individual regions

The Pilsen region has close to 207,000 sqm of space under construction. One of the projects worth mentioning is Arete’s development of a 31,000 sqm hall for Duvenbeck in Rokycany. In June, the Pilsen region also posted a significant share of speculative construction, with 102,000 sqm of the space underway still available, being approximately half of all space under construction.

In the South Moravian Region, 187,000 sqm are under construction. The largest industrial building currently under construction in the region is a hall at CTPark Blučina, which is custom-built for Inventec (52,600 sqm).

In the region of Ústí nad Labem, 165,000 sqm of rentable industrial space is under construction. The pipeline includes for example a building for Fielmann at Garbe Park Chomutov (29,600 sqm) or a warehouse for Fiege at CTPark Žatec (18,500 sqm). In June, of the space underway, 72,000 sqm was available for lease.

Prague and its surrounding area had 137,000 sqm under construction in the middle of this year and almost all of that space (111,000 sqm) was still available and offered for lease. The largest buildings in this submarket are being built speculatively by CTP in Kozomín, near the D8 highway.

Historically, and this still applies today, the lowest construction of warehouse and production space for lease has been in the regional markets of Zlín, Vysočina, South Bohemia, Pardubice and Hradec Králové.