According to the latest Industrial market research by property advisor CBRE, growth in demand, encouraged by falling rental rates, was anticipated. Therefore, 41 percent of take-up relates to optimisation of costs and does not represent growth in the logistics market. Consequently, the vacancy rate remains high, and is impeding a recovery in rental rates.

Moscow industrial market tendencies in Q3 2015:

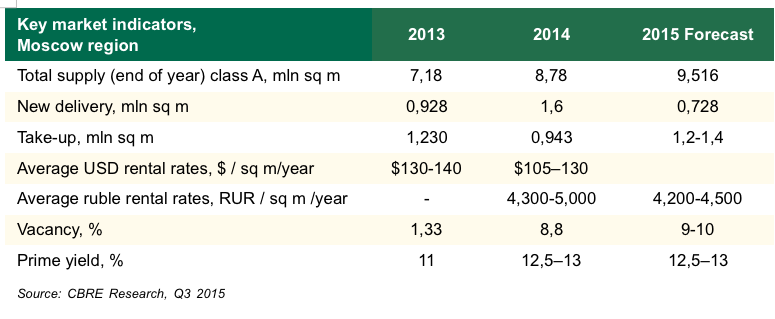

Quarterly take-up amounted to 579,000 sqm and set an all-time record. Q1-Q3 2015 take-up has exceeded 1 million sqm, which means that the level for the whole year may reach a record-breaking 1.2-1.4 million sqm, depending on the number of large deals closed in Q4.

New supply slightly exceeded 100,000 sqm. Another 44,000 sqm is to be delivered by the end of the year. As a result new supply for the year will reach 728,000 sqm. Vacancy remains at 1 million sqm, representing 10.9 percent of the total stock. Average weighted rents declined by 6 percent compared to the previous quarter and fell to RUR 4,200 per sqm per annum.

579,000 sqm was taken-up in Q3 2015, which represents a historical high for the market. Take-up this year is likely to reach a record level of 1.2-1.4 million. Sqm. FMCG and food retail companies (X5 Retail Group, Dixy and Lenta) were the most active on the demand side. Non-food and DIY retailers were second in terms of take-up.

The largest deals in Q3 2015:

X5 Retail Group became an anchor tenant in Logopark Sofyino with a lease of 65,000 sqm. FMCG and food retail chain DIXY signed two deals: a pre-sale contract in PNK-Severnoe Sheremetievo (55,000 sqm building to be constructed) in the northern part of the Moscow Region, and lease agreement of 54,000 sqm in the A-Terminal warehouse complex in the southern direction from Moscow. Children’s goods retailer Dochki-synochki leased 42,000 sqm in Logopark Bykovo (CBRE deal). DIY-retailer OBI occupied warehouse space via a direct lease for the first time (35,000 sqm in Logopark Sever 2) instead of using its logistics provider’s space (CBRE deal).

ale contract in PNK-Severnoe Sheremetievo (55,000 sqm building to be constructed) in the northern part of the Moscow Region, and lease agreement of 54,000 sqm in the A-Terminal warehouse complex in the southern direction from Moscow.

Children’s goods retailer Dochki-synochki leased 42,000 sqm in Logopark Bykovo (CBRE deal).

DIY-retailer OBI occupied warehouse space via a direct lease for the first time (35,000 sqm in Logopark Sever 2) instead of using its logistics provider’s space (CBRE deal).

There was demand on both the primary and secondary markets. However, only 40 percent of take-up resulted in a decrease in vacancy (completed buildings on the primary market and other vacant space on the open market). 37 percent of take-up was in properties which had not been previously marketed: where one occupier was immediately replaced by another or where an existing occupier/end-user took over a lease from the previous direct leaseholder.

41percent of take-up therefore relates to optimisation of costs and does not represent growth in the logistics market. This part of demand is the result of occupiers’ reaction to current market conditions via a return from full 3rd party outsourcing to cheaper direct lease schemes or purchasing (on both the primary and secondary markets). As a result, despite the massive amount of take-up, the net absorption level in Q3 was 71 percent lower, and did not significantly influence the vacancy rate.

Completions in Q3 2015 were minimal, with just two buildings being delivered (the first building in PNK-Chekhov 3 with an area of 100,000 sqm and building 9 in PNK-Chekhov 2 – 5,000 sqm).

44,000 sqm has been announced for delivery in Q4. All of this space is being constructed for specific end-users. Total completions for the year are likely to reach 728,000 sqm, which is 55 percent less than in 2014.

175,000 sqm is under construction and expected for delivery in Q1 2016. 86,000 sqm of this is available to the market.

Vacant space totalled 1.035 million sqm by the end of Q3, representing 10.9 percent of the total warehouse stock in the Moscow Region, which is just slightly less than the one last quarter (11,7 percent).

By the end Q3 2015 the average weighted rent settled at RUR 4,200/sqm/year, i.e. it reached the lower end of the range seen in Q2 2015.

Rental rates continue to be under pressure from the strong competition in terms of supply. It comes from the fact that the amount of vacant space is equivalent to two years of 2015 absorption.

The average sale price settled at RUR 40,000-45,000 per sqm.

Anton Alyabyev, Director of Industrial & Logistics department, CBRE, Russia, commented: “The main factor fuelling demand is low market prices. Current commercial terms provide occupiers with the opportunity to optimize their logistics infrastructure on favourable commercial terms. Such a situation is reflected in the nature of take-up, where 50 percent of deals relate to existing secondary market properties.”

He added, “The trend of moving from the use of 3rd party services to direct leasing/purchasing of premises is another consequence of the current market. As a result, take-up this year is likely to reach a record level of 1.2-1.4 million sqm. Nevertheless, this will not have significant positive impact on the market, because net absorption volumes remain low. Therefore, the vacancy rate remains high and is impeding a recovery in rental rates.”