Savills has launched a new Logistics Megatrends report. According to Savills, evolving technology, combined with changing consumer habits, will transform the way e-tailers distribute and deliver products to European shoppers, meaning that increasing amounts of warehouse space will be required across the continent to service demand.

Despite copious discussion of the impact of online on the high street and logistics, currently only 8 percent of retail transactions take place online across Europe. With experts forecasting this to rise to 25 percent of total retail by 2025 greater disruption in the sector is yet to come, says Savills in its Logistics Megatrends report.

Key developments likely to take place Savills predicts, include:

– Retailers and manufacturers may relocate warehouses to take advantage of cheaper locations and labour as drone technology will enable deliveries to be made from places previously inaccessible to lorries.

– Warehouses will get taller as robotics allow stock to be racked more efficiently, with automation allowing products to be retrieved from greater heights. Warehouse workers may also be supplied with robotic exoskeletons to assist them in the loading and packing of deliveries.

– Price savvy, globalised shoppers will purchase more products from retailers based abroad when delivery is not too expensive. Cross-border e-commerce could grow by 25 percent annually, which would have a major impact on where retailers and manufacturers place distribution hubs – we could see more warehouses closer to borders and more steps and locations in the delivery chain to manage custom and border checks.

– Advances in battery technology and autonomous electrical vehicles will lead to a proliferation of night time deliveries as they will no longer contravene noise restrictions –consumers may wake up to their deliveries having already arrived.

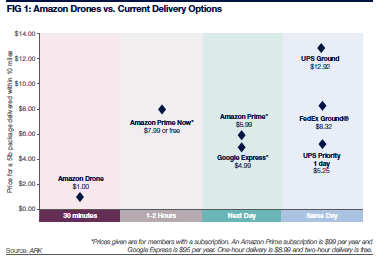

– For retailers with physical stores, improved tracking of stock will mean that deliveries can be shipped from existing shops if they’re closer to the customer, rather than from warehouses. This will cut down both costs and the time deliveries take to reach customers– could high street retailers take on Amazon Prime’s one hour delivery windows?