The current Savills “Branded Residences Report” shows that the number of branded residential schemes has increased by over 160 percent in the last decade with new brands, locations and a shift in amenities set to propel the sector even further. With more than 690 completed schemes globally, a further 600 are expected to be delivered by 2030.

Prestigious “brands” from non-residential sectors such as Versace, Fendi, Armani or Tonino Lamborghini have also expanded their presence into this segment across major cities around the globe. The concept of luxury apartment residences is based on an affiliation with a prestigious brand. The individual apartments are available for purchase on the open market and at the same time, residents enjoy access to exceptional services comparable to luxury hotels.

“The concept of branded residences is not present in the Czech Republic yet; however, it is not a novelty in Europe. There is, for example, the alpine Six Senses Residences resort in Kitzbühel in Austria, the Mandarin Oriental Residences in Barcelona or The Whiteley project that is under construction in London and will also betide to the Six Senses brand,” explains Lenka Pechová, Senior Research Analyst at Savills.

“Branded residences have diversified from being entirely luxury hotel-driven to offering products across all hotel chain scales. New brands set to enter the sector include Dolce & Gabbana, De Grisogono, Mama Shelter and Rare Finds,” says Rico Picenoni, Head of Savills Global Residential Development Consultancy.

In terms of non-hotel brands, YOO remains in the top spot, however, brands such as Pininfarina (Mahindra), Elie Saab and Versace (Capri Holdings) are set to move up the rankings over the coming years.

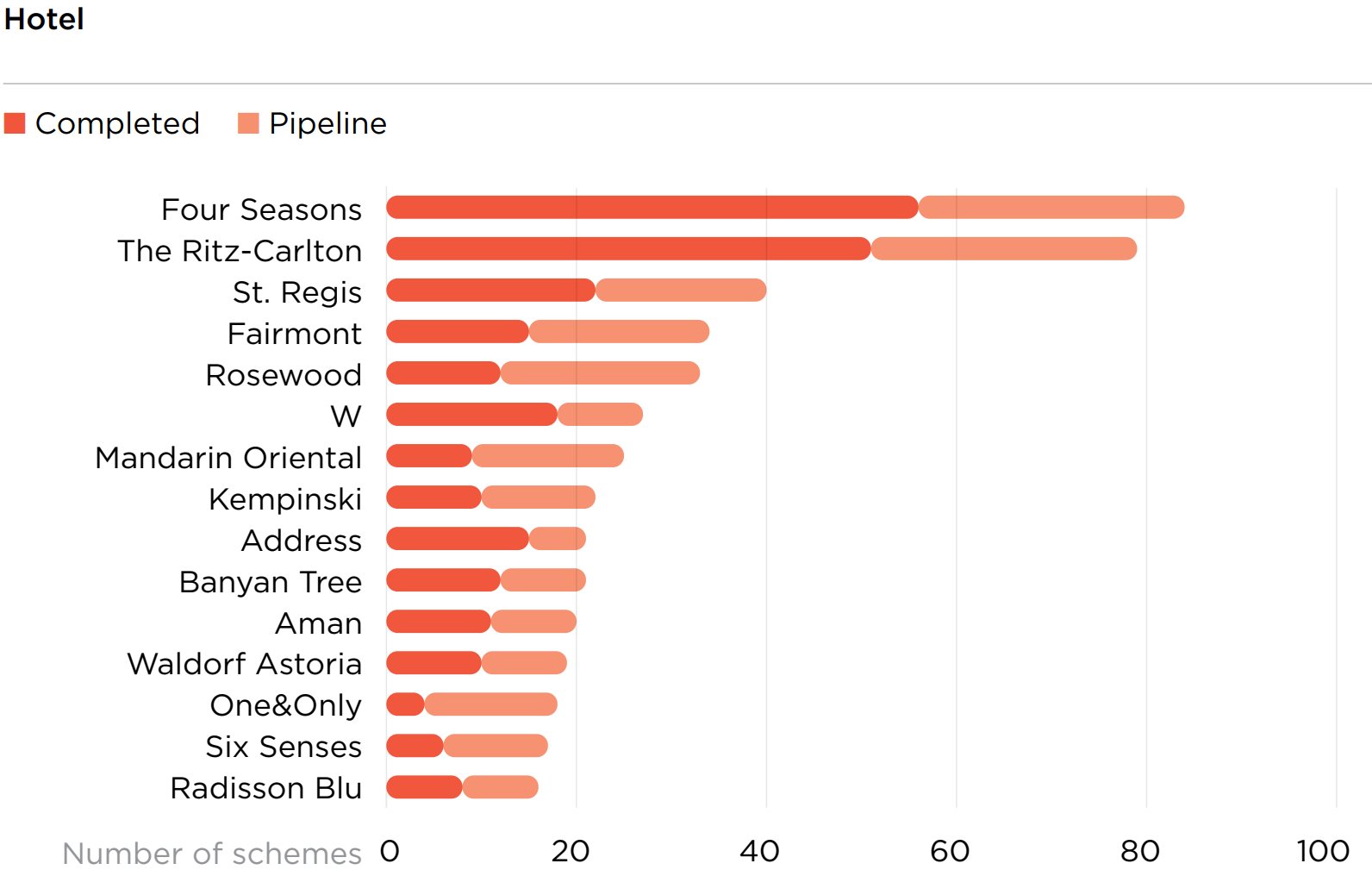

In terms of the hotel brands themselves, Four Seasons, The Ritz-Carlton and St. Regis lead the space (the latter two within the Marriott International portfolio of brands).

Savills estimates that non-hotel brands will account for 20 percent of the total supply by 2030, an increase of approximately 40 percent from current levels.

Within hotel brands, whilst luxury chains still account for two-thirds of completed schemes, upper-upscale and upscale brands are increasing their presence and are forecast to increase their market share by 50 percent and 70 percent respectively.