RICS urges policy-makers to take some key principles into account in order to safeguard the future of one of the most important sectors in Europe.

According to RICS, the voice of professionals working in the land, property and construction sector, cannot be ignored by those shaping the future of the EU / UK relationship. The sector has a significant impact on Europe’s economy, its job creation as well as on the sustainable growth of cities. The sector employs over 16.7 million people in Europe and represents 16.5 percent of EU GDP.

RICS, a professional body representing over 125,000 qualified members from the industry worldwide, is committed to ensuring that this contribution is not put at risk. Together with 15 other European industry associations, RICS offers some guiding principles for Future EU-UK Relations. These principles include:

Securing the skills base: the mutual recognition of qualifications and the development of common technical standards have reduced the barriers to cross-border services provision. These common approaches have also meant that European businesses can support best-practice in environmental, financial and social standards. Maintaining access and developing talents are critical to ensure the growth and competitiveness of the sector.

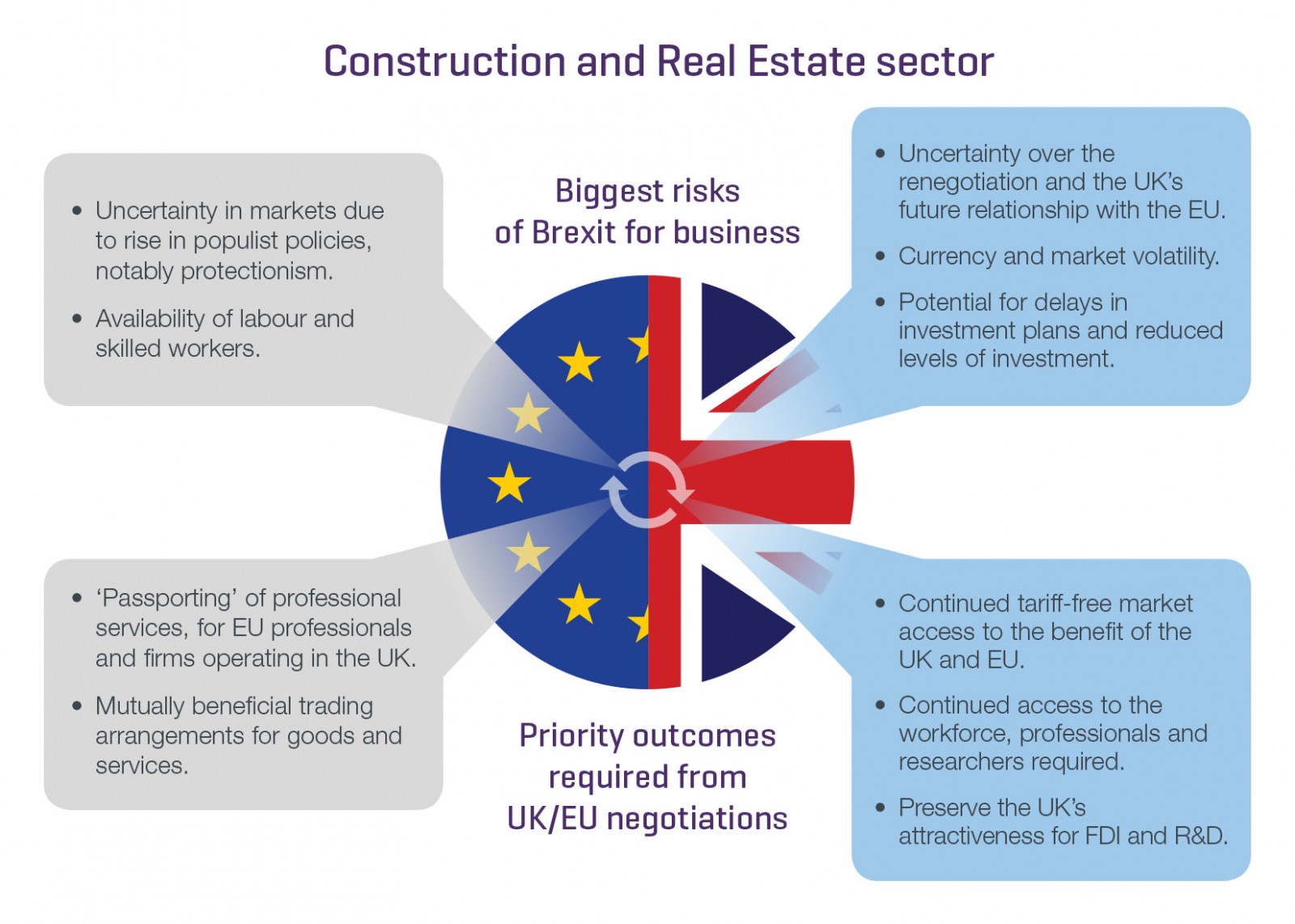

Avoiding new barriers: Europe’s real estate sector, as well as those investing in it through equity or debt, seek a future relationship between the UK and the EU that preserves the flow of skills, capital and investment between the two.

Protection of legitimate expectations and rights acquired: Because of the long-term commitments involved in real estate investment (whether in the form of equity or debt), the market relies on the existing legal framework and could be disrupted by prolonged uncertainty or sudden or dramatic changes. Frameworks such as those created by the Alternative Investment Fund Managers Directive (AIFMD) and the Market in Financial Instruments Directive (MIFID).

Maintaining market access: A legal framework that both provides access to EU markets for long-term investors, fund managers and lenders in the UK and that allows those based in an EU member state the same access to the UK market will be better for everyone.

Maintaining the momentum on existing initiatives: Whilst it is inevitable that significant resources and attention will now have to be devoted to the renegotiation of the UK’s relationship with the EU, this must not be allowed to derail or delay policy initiatives designed to boost the built environment sector. Examples include: removing barriers to cross-border investment, the Construction 2020 initiative, and several initiatives related to energy efficiency and sustainable buildings.

A transparent and open process: It is imperative that the built environment sector has the maximum possible clarity and certainty about the next steps. It is time for a clear roadmap to be agreed between the EU and the UK and communicated to stakeholders. This must include clarity regarding the scope of negotiations and provide for appropriate stakeholder involvement.