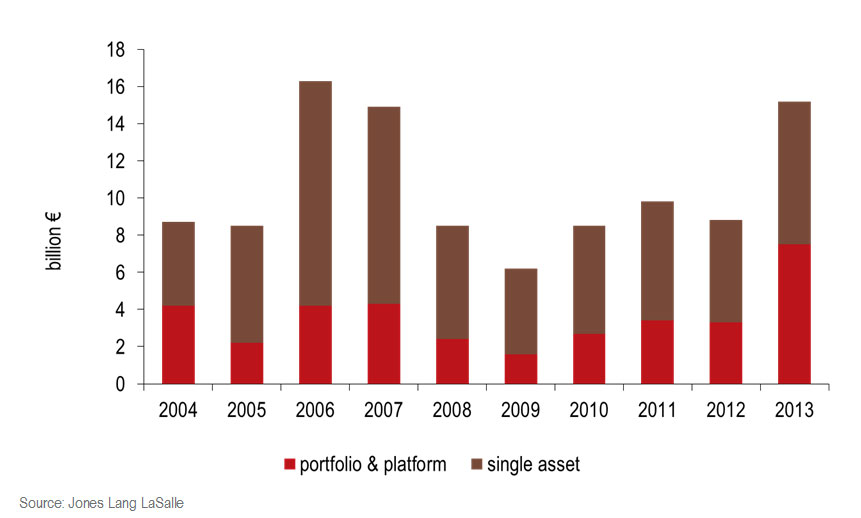

2013 marked one of the most active years to date for the logistics and industrial investment market in Europe. Total investment volumes rose 73 percent to €15.2 billion, marking the second highest volume in the last 10 years. Furthermore, the share of logistics and industrial investment increased to 10 percent of all commercial real estate volumes – up from a 5-year average of 8 percent – according to the latest figures released by JLL.

“2013 witnessed a surge in investment activity in the logistics and industrial sector. The spike in volumes was fuelled by an improving macro-economic landscape, falling vacancy levels, a tightening of supply and occupational demand driven by factors such as the continued growth of e-commerce and changing shape of retail markets. This has led to some downward yield movements in a number of markets, which we expect to see continuing in 2014. Investors continue to be attracted to the sector by the ability to build scale across the region, the returning availability of debt and the possibility of capturing rental and capital growth,” commented Tom Waite, Director European Capital Markets at JLL.

With a growing range of international investors seeking to gain exposure in the sector, platform and portfolio deals accounted for almost half of the total volume in 2013 marking a 130% increase year-on-year. Meanwhile, inter-regional capital flows also rose significantly and at €6.2 billion were 77 percent ahead on 2012. This furthermore highlights the growing maturity of the asset class.

Europe’s traditional core markets – the UK, Germany and France – continued to be the most traded in 2013. Nevertheless, a lack of prime product along with continued yield compression meant investors were increasingly looking for opportunities elsewhere in Europe. 45 percent of the total investment was recorded in markets outside the ‘Top 3’ in 2013, up from a 30 percent share in the previous year.

Both the Nordic Countries (+84 percent) and the Benelux (+44 percent) saw full-year volumes rise strongly albeit on the back of lower levels. Indeed the majority of these markets still account for only a marginal share on the European total. Investments rose by 12 percent in the Southern periphery as well, mainly driven by slowly returning activity in Italy, although volumes remained subdued overall.

Meanwhile, Russia booked a record €800 million in 2013, up 137 percent, albeit the market remains dominated by a small number of domestic investors. CEE markets, which saw continued strong investor interest, although recorded an active 2013 with levels in line with the 5-year average. However, volumes declined in Poland on the back of the 2012 record when two large portfolios were traded, leading to an overall 28 percent decline over the whole region.

Strong investor demand has led to further yield compression across several markets over the final quarter of 2013. As a result, the weighted European average yield moved in 10bps quarter-on-quarter to 7.30 percent.

“In 2014, we will continue to see strong logistics and industrial transaction volumes as in particular the logistics sector will benefit from continued strong market fundamentals. Occupier demand for logistics units will be further driven by structural change in supply chains. Short term this change will be dominated by the evolving e-commerce markets as retailers are now forced to offer an omni-channel retail experience to their customers to remain competitive. In addition, over the medium term, we already see several other trends emerging that will increasingly impact on logistics real estate strategies, including 3D-printing and climate change,” commented Alexandra Tornow, Head of EMEA Logistics & Industrial Research at JLL.

Total 2014 investment logistics and industrial investment volumes are projected to exceed the 2006 peak at €16 billion. With the momentum of 2013 carrying over into 2014 continued yield compression is also expected in particular across the laggards in the CEE and Southern Europe.