As Poland’s construction market matures and the economy is saturated with new investment projects, renovation works and upgrades will be making an increasing contribution to the construction sector in the coming years. This trend has already been observed in residential construction and, to a certain degree, non-residential construction.

The collation of data on construction and assembly output broken down into types of work, which was carried out for the needs of the report “Building repairs and upgrading in Poland 2016. Market analysis and development forecasts for 2016-2021”, reveals that civil engineering construction was the only segment to see a marked increase in the contribution made by projects involving construction of new structures in the recent years. The main cause of this development has been the implementation of numerous large-scale infrastructural projects financed with the EU funds. In the non-residential construction segment, the upturn was really modest, while the residential construction segment saw a surge in the significance of repair works, i.e. projects involving maintenance of existing buildings’ technical condition rather than construction of new dwellings. We expect that the trend will gain momentum in the coming years. As a result, in several years’ time, the Polish market will increasingly resemble its Western European or Scandinavian counterparts.

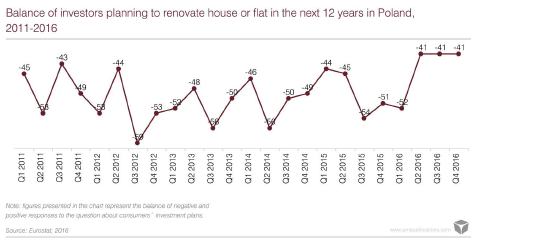

A higher proportion of repair works planned in the residential sector was also revealed in the Eurostat quarterly consumer survey where the proportion of Poles intending to renovate their house or flat in the following 12 months was fund to be the highest in many years.

The growing significance of repair and modernisation works in residential construction is also confirmed by the findings of PMR’s report entitled “Home furnishings, equipment and DIY retail in Poland 2016. Market analysis and development forecasts for 2016-2021.” A survey of a representative sample of 600 Poles conducted for the report shows that one out of every two repair projects was completed by the respondents themselves or with the help from their friends or family. However, the higher the revenue, the less likely the respondents are to handle the work by themselves and the higher the proportion of repairs conducted by renovation and construction companies.

The results of the survey show that the way renovation works are carried out differs also depending on the size of locality where the respondents live: those living in rural areas and small or medium-sized towns were more likely to perform home renovations on their own or helped by close relatives. Residents of large cities usually had the whole of renovation work done by a professional renovation crew.

Traditionally, the most common type of renovation work involves refreshing of interior walls (86 percent of responses). Moreover, one out of every two repair projects involves refinishing of floors (50 percent of responses), wallpapering or tiling (46 percent of responses). As in the previous waves of the survey, these kinds of projects were the most popular types of renovation works completed at Polish houses and flats.

In 2016, the average home renovation cost (the entire place or part of it) was approximately PLN 18,000, though it should be added that the amount was under PLN 10,000 for half of the respondents.

Almost two-thirds of the surveyed Poles purchase materials they need for home renovation in DIY stores. This has been the most popular distribution channel used by Poles undertaking home renovation projects for many years.