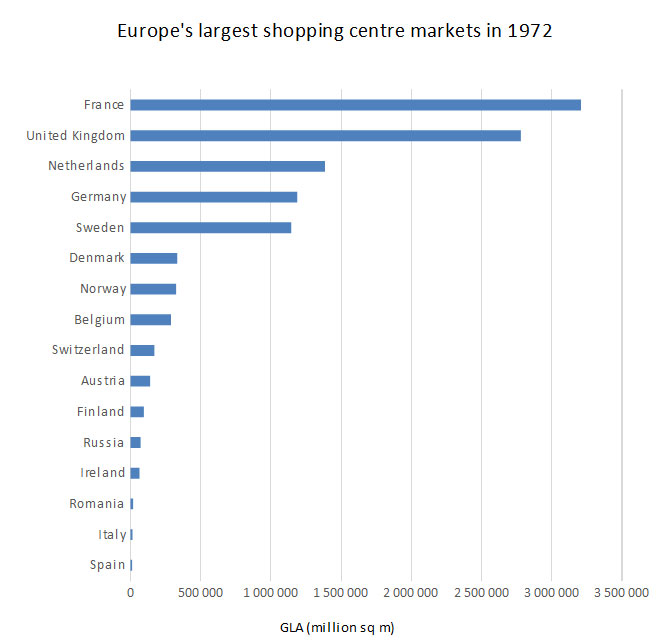

After a number of large-scale malls were delivered to the European market in H2 2014, Russia has now broken France’s 43-year reign as Europe’s largest shopping centre market – according to new research from global real estate adviser Cushman & Wakefield.

Accounting for more than half of all shopping centre space added to the market in H2 2014, Russia’s total shopping centre stock climbed to more than 17.7 million sq m as at the end of last year, overtaking France’s 17.66 million sq m GLA. The UK follows behind as Europe’s third largest market with 17.1 million sq m. Poland is on the 7th place on the list of Europe’s largest shopping centre markets.

According to Cushman & Wakefield’s latest European Shopping Centre Development report, total shopping centre floorspace across Europe totalled 152.3 million sqm as of 1 January 2015, recording a 3.3 percent year-on-year increase. While Western Europe currently accounts for 69 percent of total built space, development activity in Central and Eastern Europe (CEE) surged ahead in H2 2014, with 2.2 million sqm of space delivered to the market compared to 981,000 sqm in Western Europe over the same period.

Development activity throughout Europe has been motivated by the need to meet consumer demand for larger centres which offer a greater diversity of retailers, an array of leisure activities and a wider choice of food and drink offerings.

Western Europe’s biggest markets have seen an increasing number of extensions and refurbishments as developers seek to ‘future-proof’ small or outdated centres, whilst CEE is still dominated by the creation of new, dominant regional centres that serve a wide catchment area. These trends will continue into 2015 and 2016, with Russia and Turkey continuing to dominate the development pipeline as overall density remains at a low level, albeit the completion of projects of Russia will be subject to financing conditions and the wider geopolitical environment. In Western Europe, development activity in markets with lower densities such as Italy and Spain are also gaining momentum, with Italy’s pipeline over the next two years more than doubling that of the UK.

Cushman & Wakefield’s head of retail services in Russia, Maxim Karbasnikoff, said: “The Russian retail market has been under unprecedented pressure since March 2014. In addition to the Ukrainian crisis and following sanctions, rouble and oil depreciation especially in the second half of last year has placed occupiers into a near panic situation. Unsurprisingly, the exceptional volume of new supply delivered remains partially vacant, with occupiers being more focused on the optimisation of the existing network, rather than opening stores without economic visibility. Nevertheless, stable retailer sales in Q1 2015, recent rouble appreciation, low vacancy in existing malls and a somewhat more limited pipeline of new projects, makes us think the market is showing signs of resilience and has now entered into a consolidation phase.”

Investment demand has been exceptionally strong over the past year and with the ownership of a number of top tier centres changing hands, prime yields have compressed to near pre-crisis levels in many markets. A lack of modern supply is frustrating investors, however, leading to a further spreading in demand towards new target markets such as Spain but also encouraging more interest in second tier markets and assets to find opportunities. Portfolio restructuring by funds and in particular leading REITS has created new supply in some markets but an increase in development will be yet more crucial to feeding investor as well as retailer demand in the future.

Cushman & Wakefield’s head of EMEA retail, Justin Taylor, said: “With the rise of online sales, the ability for customers to be able to interact with their favourite brands in a well-designed, exciting and culturally-rich environment has never been so important. Throughout Europe, many developers have opted to build increasingly large-scale schemes with significant leisure offerings and an increasing share of food and beverage operators in order to give centres a unique identification.”

Development in Poland in 2014 occurred mostly in smaller, regional cities with less than 100,000 inhabitants, including the opening of the Galeria Siedlce in Siedlce (33,500 sqm), Galeria Bursztynowa in Ostrołęka (27,000 sqm), Galardia Centre in Starachowice (18,750 sqm) and Brama Mazur in Ełk (16,250 sqm). Poland is on the third place in the top 10 countries in Europe for pipeline development 2015-2016 ranking. Development activity is expected to intensify over the next two years: projects such as the 50,000 sqm Zielone Arkady scheme in Bydgoszcz opening at the end of 2015 and the 100,000 sqm Posnania in Poznań opening in 2016 demonstrate the rising demand in Poland’s larger cities for large, modern centres. Warsaw remains one of the most under-saturated cities in the country with density at 520 sqm/1,000 population and is likely to remain so in the short-to-medium term.

Marek Noetzel, Partner, Head of Retail department at Cushman & Wakefield in Poland, said: “Both investors and developers have focused on redevelopment and refurbishment of existing retail schemes in response to increased market competition. Small and medium-sized cities are becoming hotspots for activity. The Polish retail market is expected to grow further benefiting, among others, from the projected strong GDP growth.”