The strength of the retail investment market in late 2013 has carried over into 2014, with volumes ahead of the wider market and also up on the same period last year. Supply nonetheless is failing to keep pace with demand and with much of the available sales inventory taken up in Q4 and now Q1, the choices open to investors are becoming more restricted, driving investors to look further afield either by geography or asset quality.

According to Michael Rodda, Head of EMEA Retail Investment at Cushman & Wakefield: “As investors become more footloose it is the actual availability of product, and particularly the availability of large assets, which is key to determining where they will focus. Germany was a significant winner in Q1, overtaking the UK for the first time since 2012, thanks to a number of large single asset and portfolio deals and strong domestic as well as international demand.”

The core markets of Germany, the UK and France in fact drew a market share of 68 percent in the quarter compared to 60 percent in 2013. However a range of smaller markets are also increasingly popular, with Spain, Austria, Italy, Ireland and the Netherlands all seeing good growth in the past quarter compared to Q1 2013.

According to Rodda: “Private equity from European and global funds is continuing to flow south but a lot of more risk averse money is also getting more mobile, with smaller core markets such as Belgium and the Netherlands being favoured as well as the Nordics, which had a slow first quarter but are seeing strong demand from an increasingly international audience when the right stock does come available.”

Shopping centres are in focus for a growing range of players, as shown by recent Chinese and Malaysian interest in the UK market, with mega schemes in particular witnessing strong demand. While the majority of investment is focussed on the shopping centre market, private domestic and international buyers and occupiers remain keen investors in core high streets while retail warehousing is seeing improved demand from domestic and some pan-European players.

Overall, according to Rodda: “The market is still in the early years of a rebalancing with cross border funds and global capital in particular set to be of sustained higher importance in the next few years as these players build out their portfolios.”

The UK saw a 27 percent increase in activity compared to the first quarter of last year with higher levels of demand moving towards secondary assets as the prime market grows more crowded. Germany however beat this with a 116 percent increase while the Netherlands became the third most active market over the quarter with a near 5 fold jump in volumes to €726 million. This is, however, still significantly below that of the two heavyweights, the UK and Germany, which each saw €3.4 billion traded.

Commenting on these geographical patterns, David Hutchings, Head of EMEA Investment Strategy at Cushman & Wakefield said: “Southern Europe continues to move up in popularity, with Spain in particular attracting a lot of interest but Italy ahead of last year and Portugal also seeing stronger levels of interest if not yet deals.”

In Central & Eastern Europe, Poland and the Czech Republic were up strongly on Q1 2013 while Russia saw activity fall as uncertainty in Ukraine and over sanctions impacted. Nonetheless, according to Hutchings: “Central & Eastern Europe is likely to be increasingly on the agenda as investors look for the next market to bounce. Poland and the core Central European markets will be in the vanguard but interest is already starting to emerge in smaller markets in the Baltic’s and Balkans and Turkey looks likely to be a key benefactor by year end.”

With stronger retail spending and more demand from local and international retailers, investor faith in the sector will only grow in the months ahead.

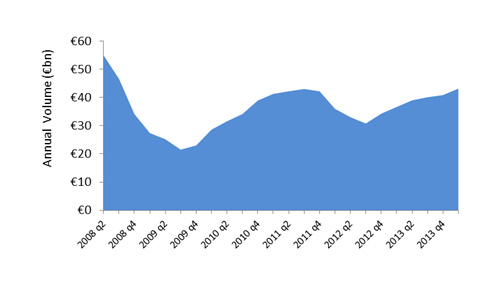

“Our expectations for activity this year have edged up, with a 15 percent increase to something like €47 billion now forecast. Supply shortages are the one thing that could hold the market back but it looks likely that more stock will be coming forward, possibly with real competition to get property onto the market after the summer leading to a healthy Q3 and Q4. However, while there may be somewhat more choice in the market, there will also be higher prices, with prime and good secondary yields now compressing,” Hutchings concluded.